“It’s a Balance” isn’t always the answer

Faced with two conflicting choices, what should you do?

Ironically there are several answers, which are themselves conflicting:

- “It’s a balance”

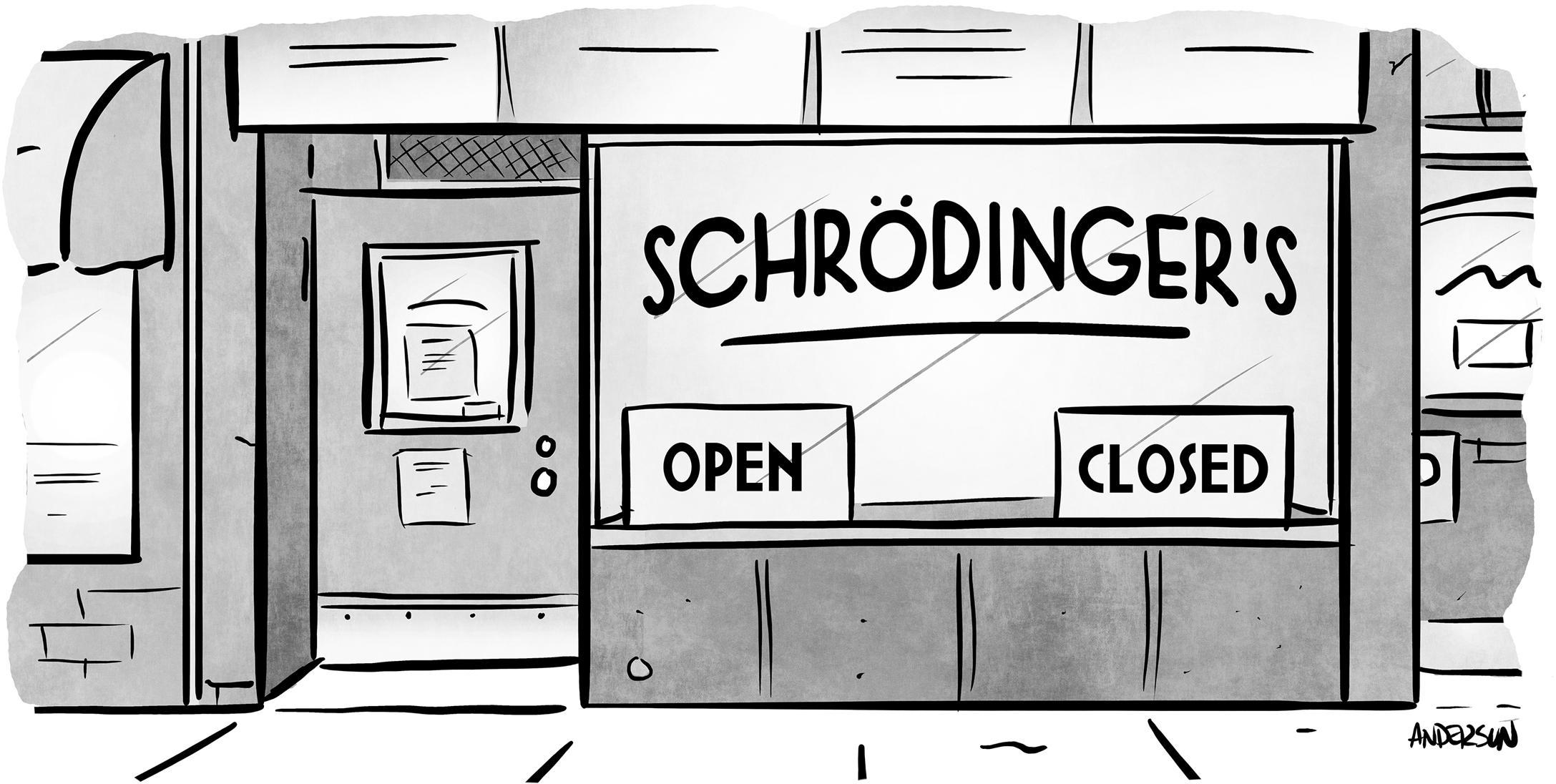

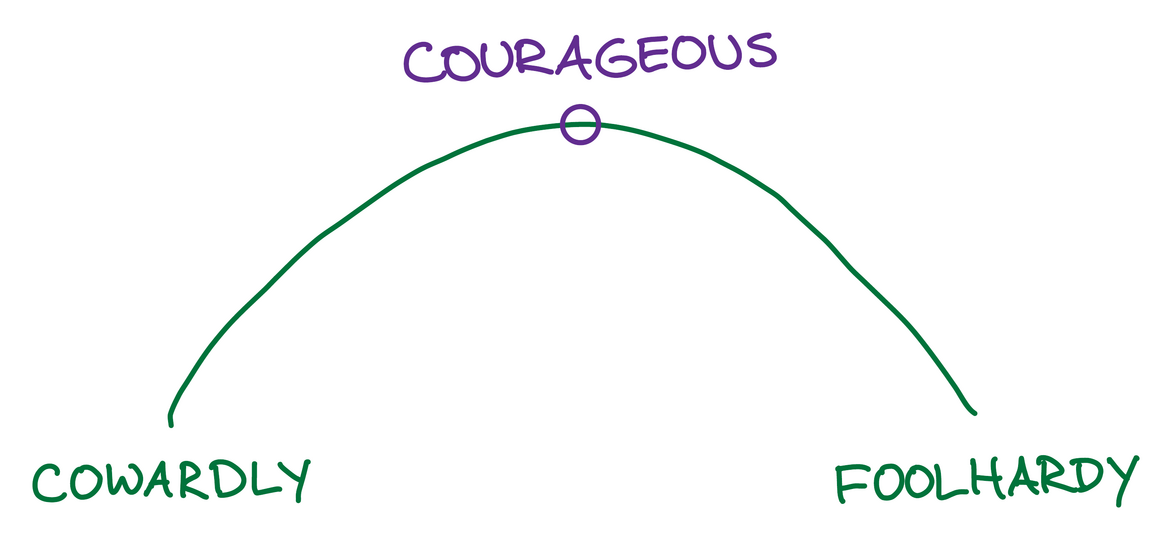

- After his enlightenment, the first teaching of the Buddha was to solve contradictions through “The Middle Way” (Majjhimāpaṭipadā). Aristotle instructs the same in Nicomachean Ethics, observing that one should be neither cowardly nor foolhardy; rather one should be courageous—facing and understanding risks, while also overcoming fears. Therefore, avoid extremes, and find the balance.

- “It’s a choice”

- Only by making a clear and extreme choice can you enjoy the full benefits of that choice. Otherwise your energy and output are diluted into failure. If a product could either be inexpensive and target small businesses, or expensive and target large enterprises, the correct answer is not a middle-price targeting the mid-market. Strategy requires making decisions, not compromise.

- “Why not both?”

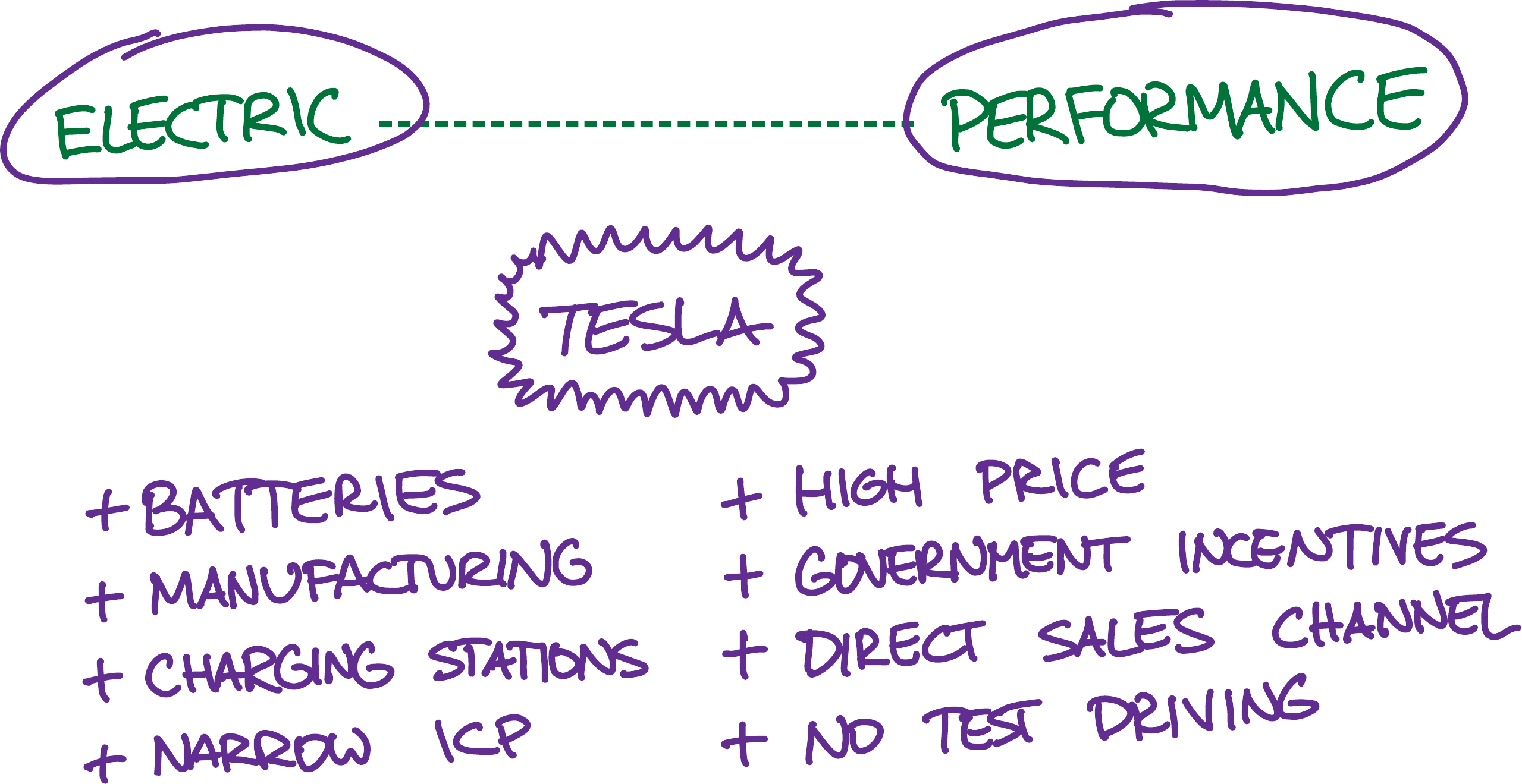

- When faced with solving the global energy crisis, picking between affordable dirty energy and clean expensive energy, surely the answer is to invent energy sources that are both clean and affordable. Though it’s an over-used example, Tesla’s cars were unique because they were both all-electric and high-performance (and maximally safe)—factors which others assumed or even insisted were impossible to achieve simultaneously.

Since there are multiple approaches, we need a framework for analyzing the decision, and deciding which type of resolution is appropriate.

“It’s a balance”

This is the correct approach when both extremes are bad.

In the Aristotelian example, the poles are both poor choices—we should neither be too scared to act, nor oblivious to risks and reality. That means we want to distance ourselves from both, not “take the best of both.” Presumably there is something in-between that reduces the negatives of each, thereby achieving a solution that is superior to either extreme.

You could visualize this as a curve you’re trying to maximize:

Figure 1

“Work vs Rest” is common example. Athletes who overtrain don’t achieve peak performance. Athletes with natural talent who don’t train will never become great. Athletes therefore need a system that intelligently alternates training and rest.

We’re tempted to call this a “balance,” but I dislike that word because it can imply “equal parts of each,” which is rarely optimal. It is not only the right amount of each, but also combined with a system that forms an integrated solution. So for an Olympic athlete it’s not “equal training and rest,” but a plan that results in peak performance on the critical day when they will contest the gold medal. The “right system” will vary by person, by goals, and by circumstance.

“Zero-sum games” are another class of puzzle that falls into this domain—where more of one thing necessarily means less of the other. Time and money are often like this; when you spend time or money on something, it means you’re not spending it on something else. So if the question is whether a solo founder should be spending time on product or marketing—making stuff or selling stuff—the answer has to be something like “a balance,” but that doesn’t mean splitting time equally. It depends on what the company needs more right now: more new customers, or retaining existing customers. Or stated in the negative: Which is the biggest problem right now: that customers are rejecting the product, or that not enough potential customers are trying it?

“It’s a choice”

This is the correct approach when both extremes are rational, yet contradictory.

A example facing all B2B companies at their inception: Should you target the low end or the high end of the market?1 The world contains a thousand times more small companies than large, but small company budgets are also a thousand times smaller. When you’re a company like WP Engine2—a platform for “websites,” needed by every company of every size—it is tempting to say “we’ll serve everyone,” as this maximizes the size of the potential market. We’ll be simple enough for small companies, but with mature compliance and features for large companies.

Tempting, but wrong. A new startup must find its Carol—it’s ICP—then focus positioning, marketing, brand, and most of all, product, on that one segment. The linked article explains why.3

1 Of course it’s typically more segmented than this, but let’s be reductive for the sake of example.

2 I founded in 2010, now a unicorn with 1200 employees, profitable and growing, serving many market segments.

3 WP Engine started with SMBs served by small agencies. Only after we reached $10M ARR, and had anchor enterprise customers, and enough funding to invest, and invested simultaneously in marketing, sales, support, and infrastructure for larger websites, did we decide to expand into larger customers.

Hopefully it’s obvious that you shouldn’t pull an Aristotle, saying “We’ll make a product for the mid-market.” While that may indeed be a good segment, you would make this decision by analyzing the best segment for your company, not because mid-sized companies are a “balance” between small and large.

When the extremes are bad you seek a balance, but when the extremes are both rational choices, it is not a balance but rather a choice, and choose you must. Trying to find a “balance” means “failing to make a decision,” which is at least suboptimal, and probably downright bad. Great strategy requires making clear, firm decisions.

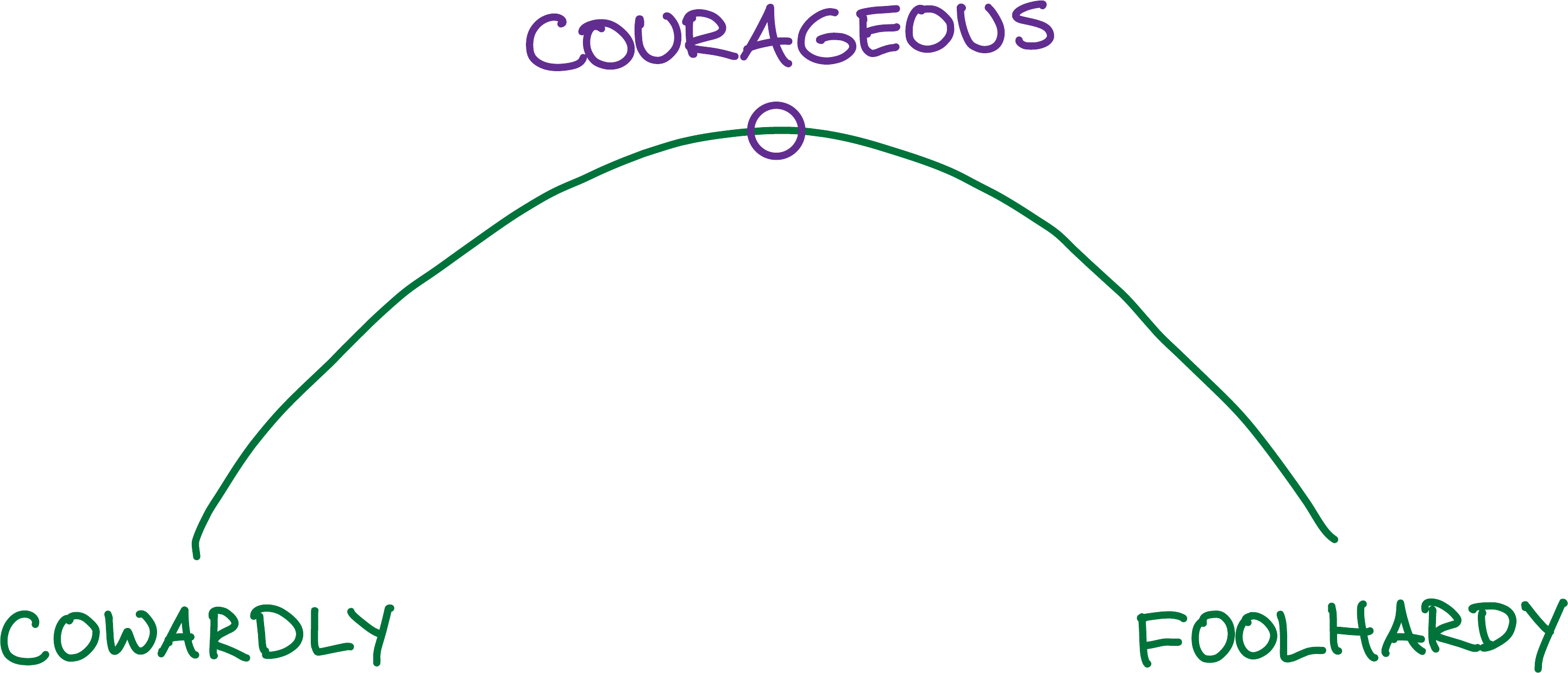

The diagram collapses to a choice:

Figure 2

This is often the case with strategic decisions. Consider the choice between building a business that is profitable regardless of its size (required for self-funded businesses) versus a business designed to grow as fast as possible regardless of profitability (required for “winning the market,” or for significant investor returns, or for making an impact on a large number of people). Either is a rational goal, but each requires different processes, mindsets, activities, and choices. Advice from the internet often doesn’t specify which goal it’s designed for; perhaps even the advice-giver doesn’t know. Applying a mixture, or a “balance” of these ideas, reduces the chance of either outcome.

Another example is targeting niche versus broad markets. Niche companies need to speak only to that niche; broad must appeal to a wide variety of people. Niche needs to charge more, because there’s fewer potential customers and because more value can be delivered per customer; broad needs to be inexpensive, as most people and businesses have little money, especially outside of the West. Niche is delivered in one language; broad thrives with forty languages.

This is also how to resolve the apparent paradox in all startup advice: For anyone who tells you “Successful companies do X,” you can always find someone else saying “Success comes from avoiding X.” Indeed, it’s easy to find examples of both successes and failures, for each opposing admonishment! This is the “startup advice” equivalent of the old observation that “proverbs come in pairs.” Example: “They who hesitate are lost” but also “Good things come to those who wait.” Or “Many hands make light work” but also “Too many cooks spoil the broth.” All are true—that’s why we repeat the bromides—the solution is to pick the advice that best matches the context you are in, and the goals that you have.

Often people claim “it’s a balance” to justify their refusal to make a decision. Whenever you’re tempted to claim The Middle Way, pause to make sure that is the correct approach to solving the contradiction.

“It’s a choice… to a limit.”

This modification to “It’s a choice” is the right approach when one choice is the answer, but the other choice cannot be completely ignored.

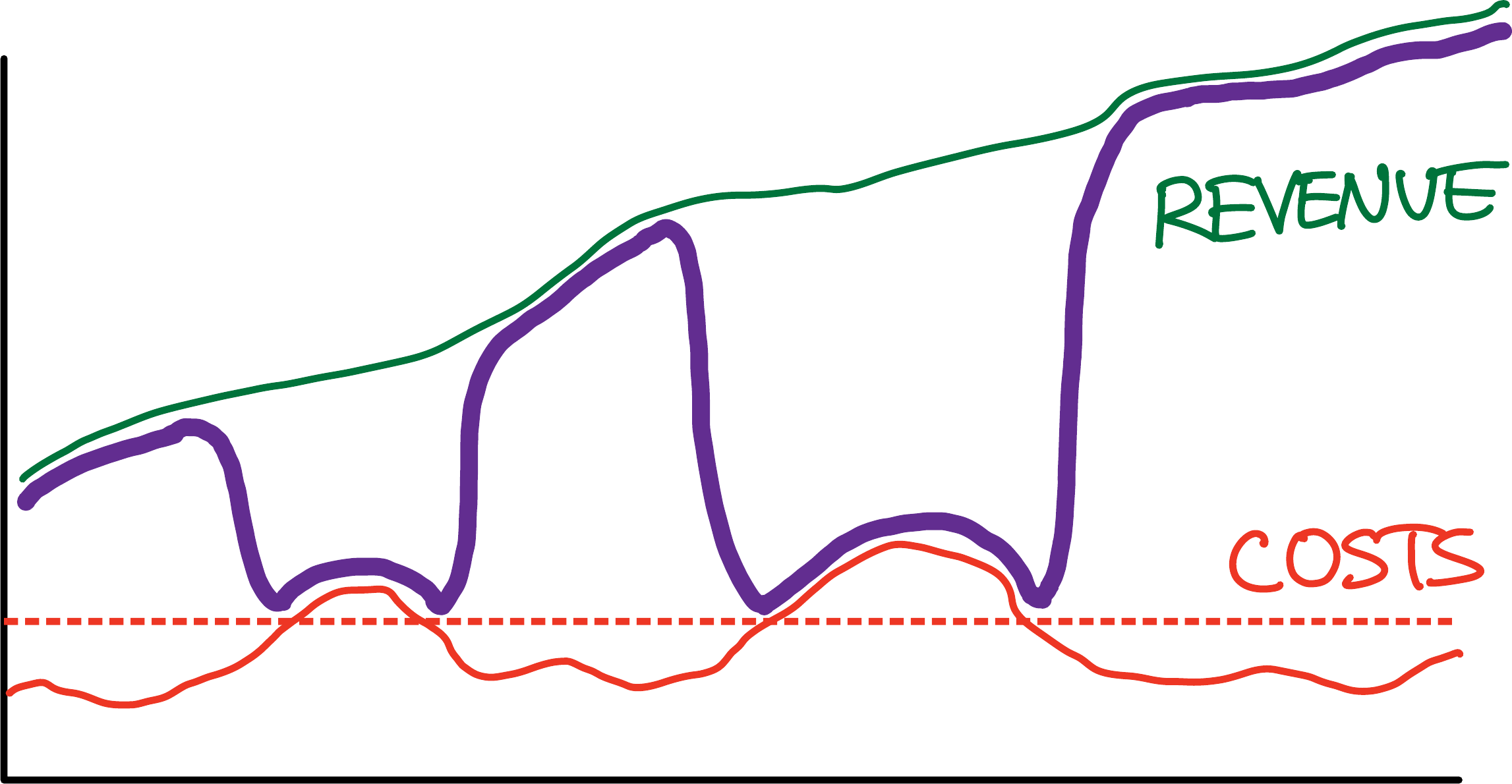

The traditional VC-backed company is trying to grow as fast as possible, and thus traditionally it spends more money than it makes. We would say: It resolves the choice between maximizing growth and maximizing profit, by maximizing growth.

However, nowadays (2024) both private and public markets are rewarding companies only4 if they have at least some profit. Valuations might be several times higher for otherwise-equivalent companies with −5% versus +5% profit margins. Therefore, the current choice among these companies is to maximize growth, but only if profit doesn’t dip below some threshold.

4 Except for AI startups.

This does not mean it’s a balance; it is not a middle way, not a compromise. The goal is still to maximize growth. It’s that costs are a constraint. There are many examples where we have made a clear choice, but we’re constrained by some limit.

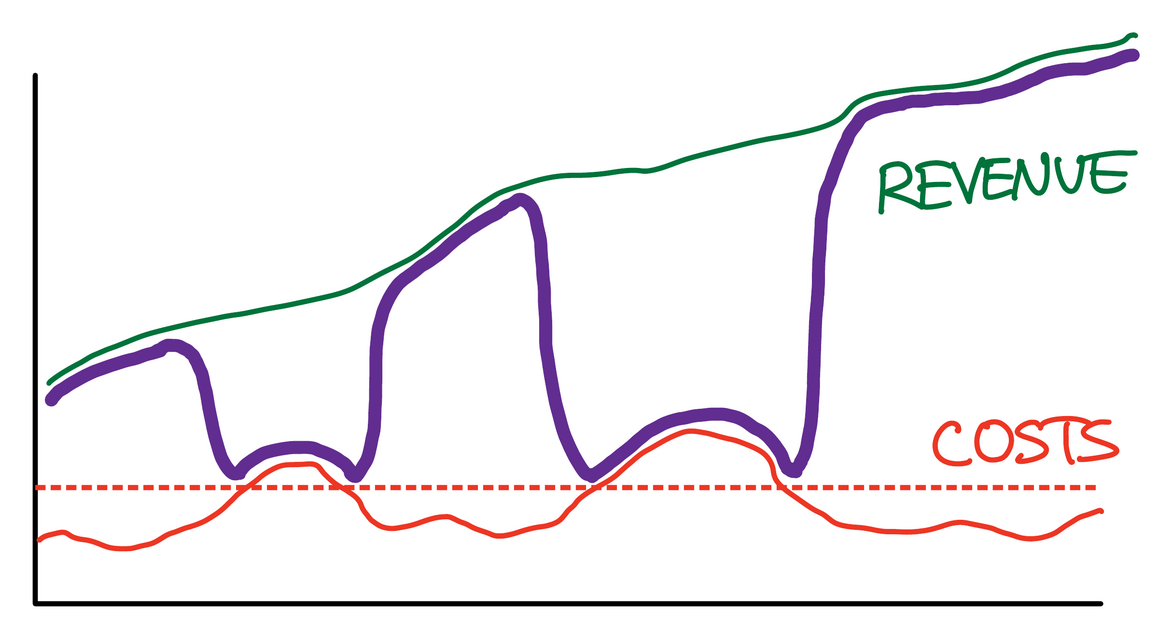

In this mode, the answer is “Maximize A, while satisficing B.” One is the goal, the other is the governor. We turn our attention to B when it’s in trouble, otherwise we focus on A:

Figure 3: The dark line follows our attention over time: Mostly on revenue, but jumps over to costs when they grow beyond our pre-agreed threshold.

This solves the puzzle of whether we should sacrifice our health, our social relationships, and our physical or mental health, for the success of our startups. The fact is it takes an inordinate amount of time and effort to get a company started.5 It does involve sacrifice. However, there are cases where people sacrificed their physical health so much that they becoming seriously ill, or sacrificed their family so much that they earned a divorce, or sacrificed their mental health so much that they suffered a breakdown. In a few famous cases, even suicide.

5 The people who tell you otherwise have either not created the type of company you are creating, or they’re far past that point, now with the luxury of “work/life balance,” telling you that it was possible to live like that all along, despite they themselves not succeeding in that manner.

The answer is not a “balance,” i.e. not working too much. The answer is that you have to work as hard as possible without falling off the cliff. The edge can be hard to see, but the answer isn’t to back off so far as to never approach it; the answer is to toe the line, and back off slightly when you feel your feet slipping.

The best way to execute this, is to establish an objective measure of the thing that should be satisfied. That way, it’s always clear to everyone whether it’s currently satisfied (in which case we should spend no time or energy on it), or whether it’s not (in which case we need to attack and fix it as quickly as possible). This is one of the critical use-cases for KPIs and is built into my method for quarterly planning.

“Why not both?”

This is the correct approach to create novel, insightful, unique products and strategies.

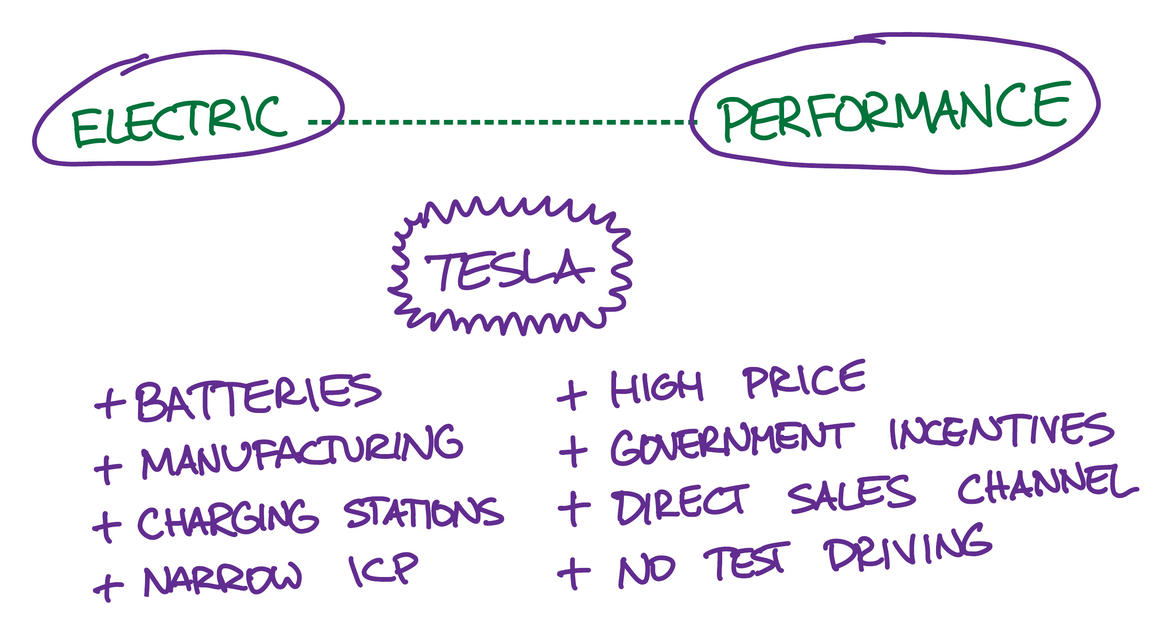

Before Tesla, there were electric cars with low performance, and gas-guzzlers who could go from a full stop to exceeding the highway speed limit in three seconds. There were car models which optimized for one extreme (“it’s a choice”) and hybrids with improved gas mileage but still low performance (“it’s a balance”).

Telsa created a third option: “Why not both.”

Before you get too excited, note this required several things:

- Invention. Something new had to be created. In this case, new technology (batteries and car design) and new distribution channels (selling directly instead of through dealers).

- Risk. There was a high likelihood that it would fail. The world is littered with failed “why not both” startups, whose post-mortems bemoan the “lack of focus” that came from “trying to do too many things at once” instead of “doing one thing and doing it well.”

- A set of additional decisions. It wasn’t enough to just invent a new battery; a series of other decisions had to be made: placing batteries in the floor to maximize handling and safety. Creating new manufacturing facilities. Spending hundreds of millions of dollars on recharging stations to address range anxiety. Targeting a market segment that valued novelty over reliability, valued performance over family transportation, and could afford an extra luxury car. Multi-national lobbying for federal donations both to Tesla and in consumer incentives. Cutting out the usual sales channel of dealerships, replacing it with cult-of-founder marketing and PR, so that prices weren’t astronomical, but which meant potential customers couldn’t even test-drive the car.

Synthesizing a new solution, which allows us to select “both,” but only if many other things are also true, is the most difficult thing to do, but also by far the most valuable.

Because it requires invention, others aren’t doing it. (Competing car manufacturers didn’t copy the batteries, even after Tesla open-sourced their patents.) Because it requires risk, others are unlikely to follow even after you start. (It took more than a decade for other car manufacturers to even attempt to follow Tesla, and even now Tesla is unrivaled in performance and safety.) Because it requires a network of other self-reinforcing decisions, it creates a unique offering, which remains unique even if competitors copy a subset of your strategy.

In short, it’s a moat—you are unique and unassailable, even by well-funded competitors.

Often the press will focus on the “invention” aspect, and indeed that’s the most interesting and press-worthy thing to talk about. But the real key is the set of “other things which also have to be true.”6 These additional decisions are what convert pure invention and wishful thinking into a complete strategy.

6 A phrase made famous by Roger L. Martin, who suggests that great strategies come from taking the several most critical things that we need to achieve in order to win, and then adding to that: “What else would have to be true?”

In particular, this means adding more constraints, more decisions, even things which are undesirable for customers or for the company, which together create an interlocking, self-reinforcing web. The undesirable outcomes are acceptable because there are always customers who value the positive more than they despise the negative, and thus you are uniquely the best product for them.

So Zappos was able to offer free shipping and free returns in apparent conflict with also having low prices, by creating scale through fiercely loyal customers, which in turn was generated by having remarkably amazing customer service, which in turn was a result of a unique culture giving unprecedented autonomy to customer-facing people. One negative side effect was low profit margins (so the resulting sale to Amazon at $1B was at only 1x revenue).

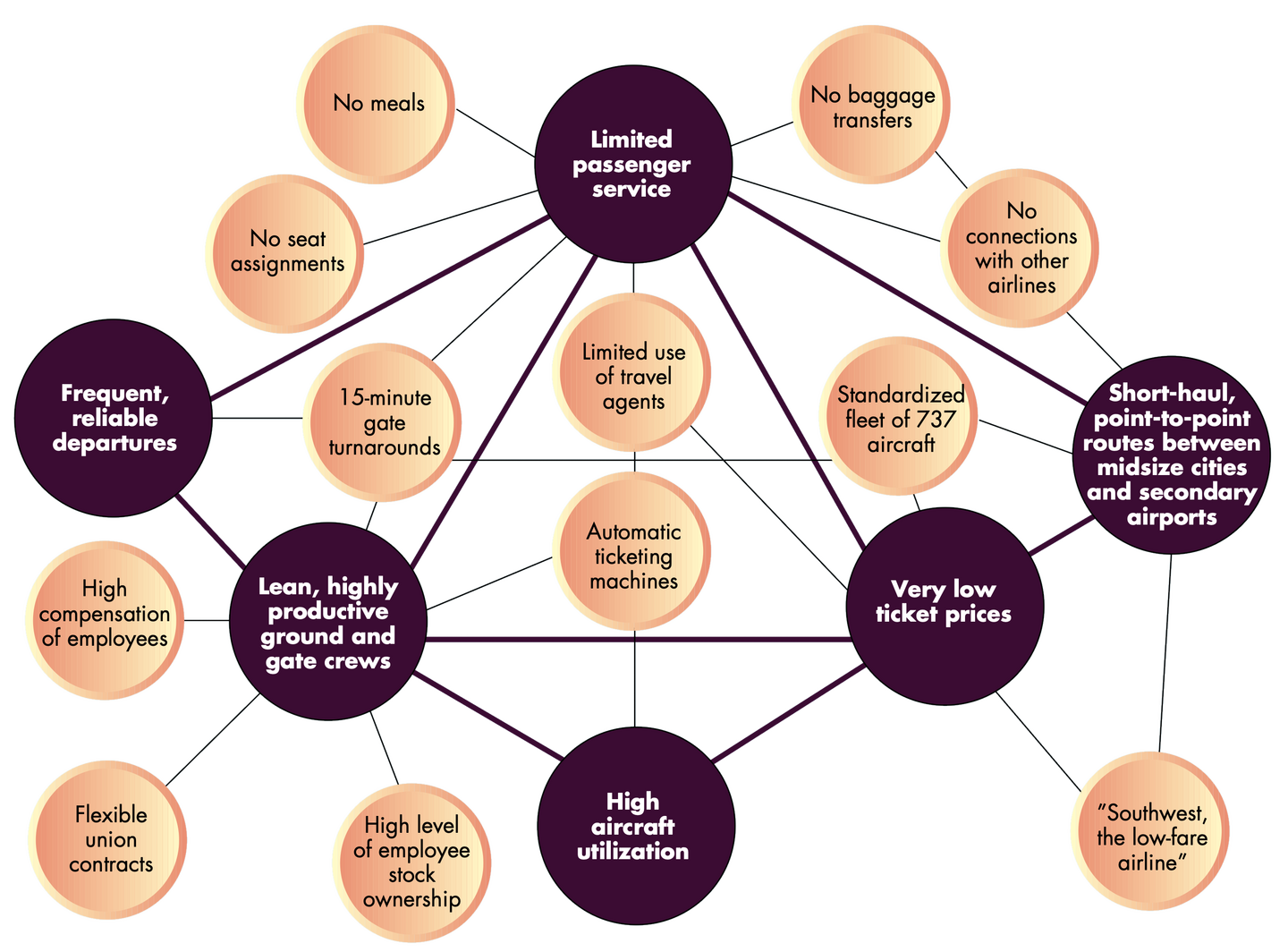

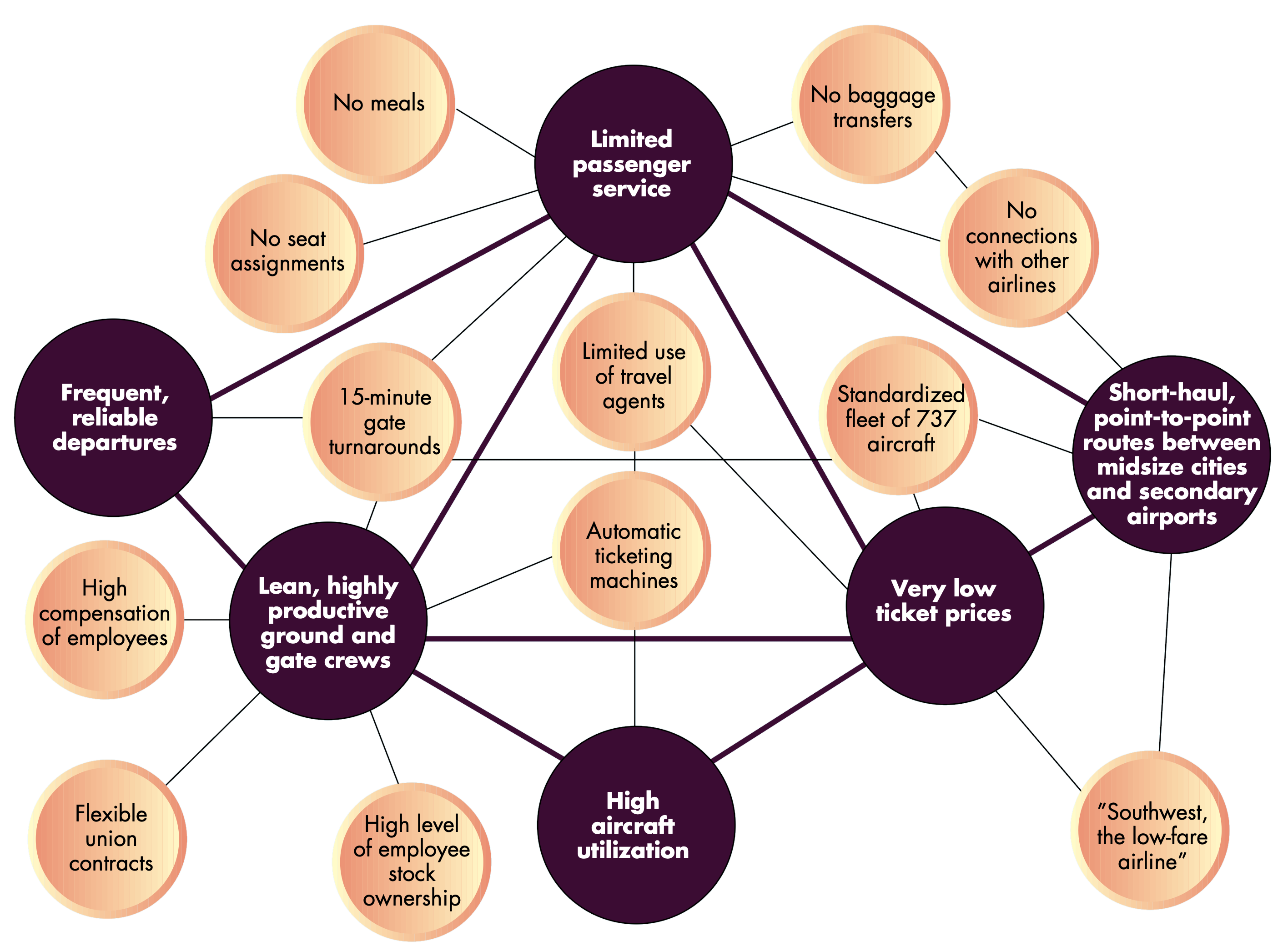

Or Southwest Airlines was able to offer frequent departures on planes that weren’t completely full, yet with the lowest fares in the industry, due to an exceptionally low cost structure. They had low costs because they used only one type of plane, ran only a few, short routes, and earned extreme loyalty from employees through a nurturing culture. The negatives included only having a few routes, and short ones, no international, no food, and more. This is more fully documented here; for decades they’ve remained true to their network of decisions (Figure 4), and have the highest profits of any airline in American history, and the only one to never have gone bankrupt.

Figure 4: Michael Porter’s “Activity Systems Map” for Southwest Airlines, from his 1996 article “What Is Strategy?” Harvard Business Review 74 (6): 61–78.

This is a common refrain in strategic frameworks. For example, the central idea of Blue Ocean Strategy is to create a new category of product through a combination of choices that are “contradictory” according to existing categories, while also solving for profitability. Seemingly impossible, certainly difficult, but nevertheless a powerful result when it is achieved.

The courage to make all of these decisions together, to accept the unique advantages as well as the undesirable consequences, is what creates the best business strategies in the world, and is the complete way of saying “why not both.”

Don’t be so quick to say “it’s a balance.” You might be avoiding a hard decision.

Or better yet, turn an apparent conflict into a unique strategy that others cannot copy.

https://longform.asmartbear.com/conflicting-choices/

© 2007-2026 Jason Cohen

@asmartbear

@asmartbear ePub (Kindle)

ePub (Kindle)

Printable PDF

Printable PDF