Avoid blundering: 80% of a winning strategy

You have been told:

- Establish a vision.

- Set goals against the vision.

- Create actions that achieve the goals.

- Measure progress against the goals.

I’ve told you that myself. It’s how you should plan work.

But… what if success is just as much about what not to do, as what to do? What if intentional goals aren’t the only way to succeed?

What if 80% of winning comes from: Not blundering.

Not blundering your way to victory

Chess Grandmaster and chess-world-famous teacher / coach Ben Finegold has a simple explanation for who wins amateur chess games:

What most people say is: “That guy is better than that guy, so that guy won.”

But that’s not why that guy won. Normally the game is very close, and then someone blunders and now it’s over.

If you look at it with a computer, it will say “no one’s winning” and then “white’s winning” and then “black’s winning” and then “no one’s winning again” and then someone blunders and they lose.

—Ben Finegold, YouTube (with light editing)

Not strategy, not memorizing opening lines, not practicing your end-game technique, not studying the Great Games of History, not drilling with puzzles to get better at tactics, … just blundering. Yes, good chess players need to do all that stuff, but we scrubs just need to “not blunder.”

Is this true for me? I’m a decidedly mediocre chess player, despite countless hours of videos, puzzles, courses, and playing. Are the outcomes of my games dictated by blunders, like Ben says?

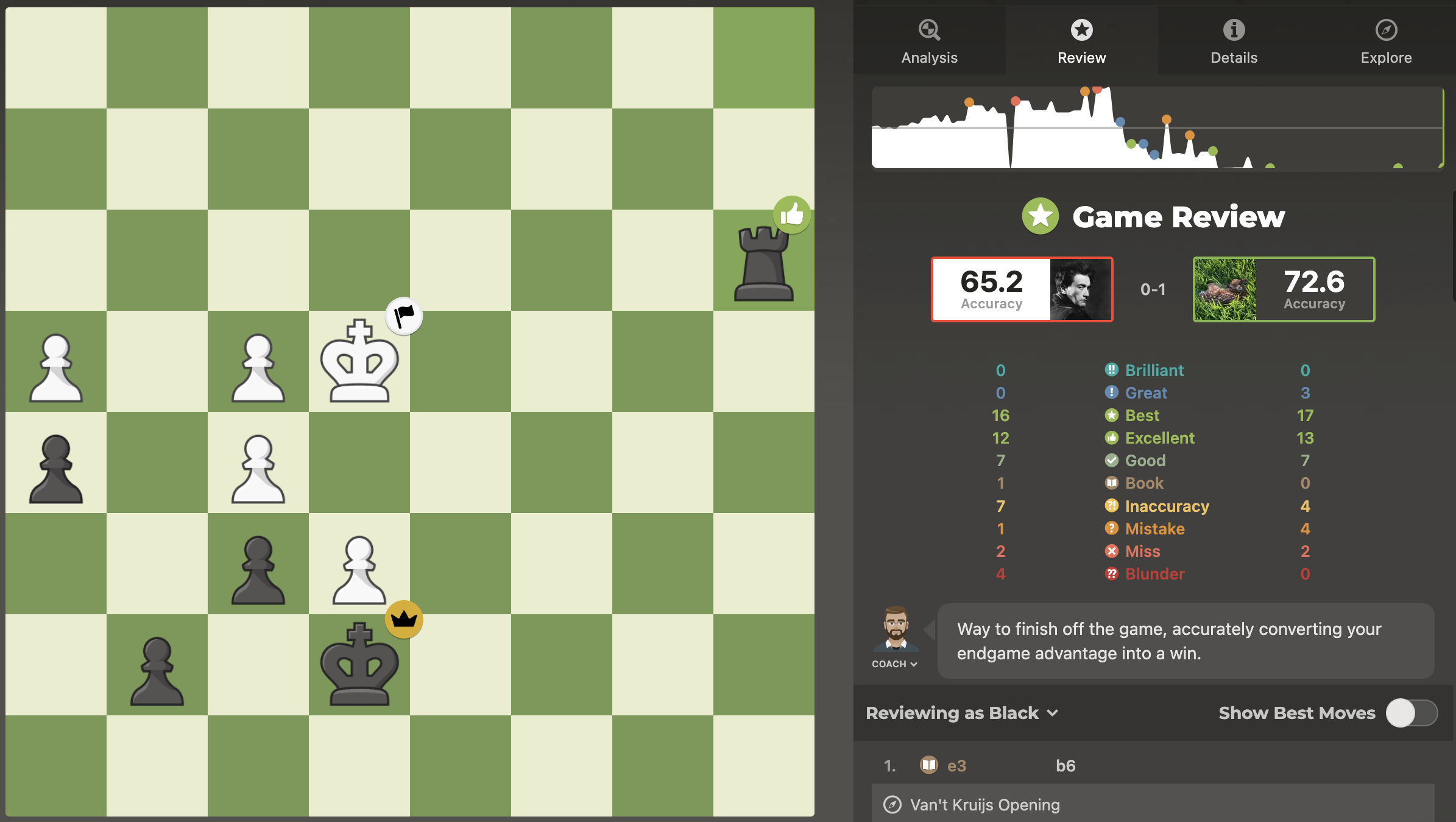

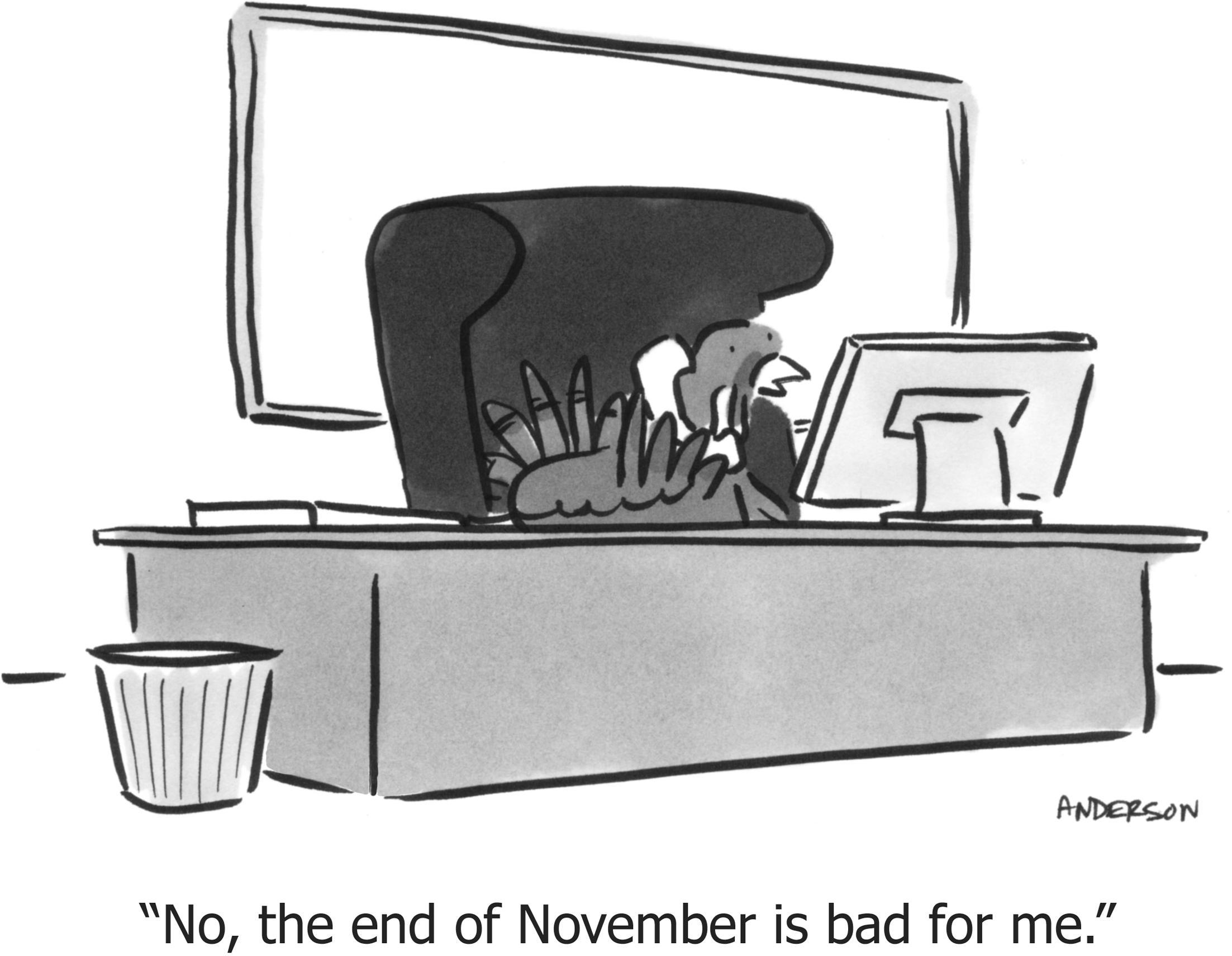

Fortunately, I have perfect data. I have hundreds of games with people who are of similar strength.1 Chess.com creates an analysis of every game, including the number of blunders, mistakes, and inaccuracies2 made by each player (Figure 1).

1 As evidenced by an even win/loss record and a similar rating.

2 The definition of these terms is not important here; suffice to say they’re in decreasing order of “how terrible that move was,” and the analysis is consistent and sensible across all games.

Figure 1: I won, thanks to four blunders by my opponent. We both suck at chess. As Ben says: The truth hurts.

I checked my last twenty decisive games. I won exactly 50%, which is further evidence that the players were of equal skill, and that the analysis includes both wins and losses.

Theoretically, the best estimator of “who will win” is whichever player has a higher Elo rating.3 In these games, the player with the higher Elo won 55% of the time—barely more predictive than a coin flip. This makes sense, because the players were close in Elo,4 which means the players are of equivalent strength, so each ought to win half the time.

3 Elo rating is an objective rating system used by all chess players for the past fifty years. It shifts after every game, calculated by which player was higher rated, and by how much, and the result of the game: win, loss, or draw. So, a higher-rated player who beats a much lower-rated player results in a minuscule change in Elo, because that was the expected result, whereas a much lower-rated player who just draws a higher-rated player will gain significant Elo.

4 Games had an average difference of 74 Elo points out of around 1100.

In my games, the player who committed more blunders lost 86% of the time. Ben is right!

However, in 40% of the games both players had an equal number of blunders. So I also included “mistakes”—the next-worst kind of error. I computed a simple “error score” that includes mistakes while giving blunders more weight:

[number of mistakes] +

2 ✕ [number of blunders]

Now almost all the games received a decisive prediction, and the player with the higher error score lost 81% of the time.

To win at chess, blunder less.

This is true across many sports. In a wonderful article, Shane Parrish recounts Simon Ramo’s analysis of amateur5 tennis games, in which he found that 80% of the points were lost rather than won. Meaning, 80% of the points were awarded to player P because player Q made an error such as hitting the ball out of bounds, or into the net, or double-faulting. Only 20% of the points were “won,” such as a powerful return that landed out of reach of the other player.

5 This observation applies only to amateur tennis. In professional tennis it’s just the opposite: 80% of the rallies are won rather than lost, as unforced errors are infrequent. This is true in chess as well, as high-level players don’t blunder, and thus it really is that litany of other skills that results in high standings.

Ramo concludes the same thing that I concluded about chess, even invoking the word “blunder”:

… if you choose to win at tennis—as opposed to having a good time—the strategy for winning is to avoid mistakes. The way to avoid mistakes is to be conservative and keep the ball in play, letting the other player have plenty of room in which to blunder his way to defeat, because, being an amateur, they will play a losing game and not know it.

Could the same rule be true of other complex systems, like startups? My amateur chess games were 80% determined by blundering, and Ramo’s amateur tennis points were 80% determined by blundering.

Could “not blundering” be 80% of winning?

Blundering in startups

It’s common to say “startups die because they ran out of money” or “startups die because the founders gave up.” But that’s like saying someone died because their heart stopped, without mentioning that they were battling lung cancer. Doctors call “heart stopped” the “proximate cause”—the last thing that happened—as distinguished from the underlying cause.

We need to identify the cancer, not just say “the founder stopped.” Otherwise, the advice for how-not-to-blunder would be “never stop.” But “never stop” is not helpful, and indeed not correct.

But it’s not turtles all the way down. We mustn’t dig too deep, as tempting as “ 5 Why’s” might be. Maybe they got cancer because they smoked a pack of cigarettes every day, so “smoking” is the cause. Maybe they started smoking to fit in with a crowd, but “wanting to fit in with the crowd” was not the cause of death, and it would be incorrect to conclude that “fitting in with the crowd is unhealthy.” (Though sloughing off that activity might help you avoid unhappiness.)

So we need to identify the blunders which aren’t merely proximate, but aren’t so distant that they are irrelevant.

There are many sources that claim to finally explain why startups fail. I’ve provided a raw list at the end of this article. I’ve deduplicated and rearranged those into the lists below, and added a heavy dose of my own opinions.

Proximate causes

First, let’s dispense with the proximate causes, as these are not real reasons, and we should neither repeat nor analyze them:

- Ran out of cash.

(A consequence of failure, not a cause. Unless you over-spent with no plausible way to recover it with revenue.) - Pivot gone bad.

(the reason you pivoted is because it was already failing) - Founder stopped.

(As opposed to what?) - Didn’t find Product Market Fit (PMF).

(a restatement of “it didn’t work”)

Bad luck

Perhaps there was nothing you could have done to predict or prevent the failure. That makes it no less real, but perhaps there’s nothing to learn from it, or to do differently next time:

- Sudden, dramatic shift in the economy.

(If COVID bankrupted the movie theater, there’s no “strategy” they should have already had in place to prevent it.) - Surprise co-founder break-up.

(Some of these are preventable—see below—but if someone falls ill, or breaks a promise, or bails, or commits fraud, it’s unclear what should have been done differently.) - Known Brittle Point

Brittle Points are single-points-of-failure in the business. All new businesses have them; it takes time and investment to address them. This is not a blunder, but a known risk. Sometimes, “known risks” get triggered.

What doesn’t kill startups

Equally interesting are things that appear on these lists, but I don’t agree that it’s a blunder.

- Bad idea.

(We’re repeatedly told that all great ideas start out looking like bad ideas,6 so “having an apparently-bad idea” cannot be a blunder by itself. It’s not the initial idea, it’s in finding the market and in the execution, iterating the idea into a working business.) - Can’t make the product.

(While this can happen, typically the founders know how to build things; indeed, building the product while ignoring all other aspects of building the business, is often the problem) - The number of co-founders.

(It’s easy to find examples of successful startups with one or multiple founders, and equally easy to find failures. It’s easy to find failures specifically due to having just one founder, or due to or having multiple. Even the great Paul Graham says in a single essay that a major cause of startup failure is “Single Founder” and later “Fights Between Founders.” I personally believe that 3 founders is a warning flag and ≥4 founders is a bright red flag, but it’s common for some of those founders to bleed off anyway (which is also why it’s a red flag). It’s more important that the quantity of founders matches the style and personality of the founders.) - Location.

(This is still a valid reason for startups that intend to scale and become Unicorns, because those startups will need to hire many people, in all departments, with experience in those environments, quickly, and that’s much harder to do in a location (including “distributed”) where the talent doesn’t already exist. This is also true of raising money. However this is becoming less true every year, and it’s irrelevant if the startup doesn’t have that goal.)

6 Originally attributed to Steven Spielberg. Attributed to Paul Graham in the context of startups. I’ve also given many examples along with how to build a strategy around it.

Preventable blunders

Self-inflicted blunders are preventable, or at least one can dramatically reduce the risk of occurrence. So, if you don’t, that’s on you.

- Didn’t talk to customers (and listen)

- If you didn’t talk to customers before you started, and especially after you started, that’s a blunder. If you talked to them and weren’t honest with yourself about what they were saying, that’s your faulty analysis. You should have used the Iterative Hypothesis Method or some other reputable framework.

- No market need / Bad market

- If the market was small and stagnant or shrinking, you already knew that. If there weren’t enough people who needed the product, you could have known that. If they don’t agree they have the problem, or that it’s worth money to solve, you could have known that. If they don’t have the budget or don’t accept the price, you could have known that. If they’re happy with what they have, you could have known that. The checklist of things that make for a good market is well-known; you don’t have an excuse for not finding out before spending six months writing code.

There’s just one mistake that kills startups: not making something users want. If you make something users want, you’ll probably be fine, whatever else you do or don’t do.

—Paul Graham

- Did not select a target audience, and clearly communicate the value proposition to them

- Speaking to everyone means speaking to no one. Speaking to everyone is a blunder; it’s laziness or fear of deciding who this product is for. This determines the language on your home page, in your advertisements, in your sales calls, inside your product. Especially now, with AI, there’s no excuse for not distilling what is special and vital about you, into language that your target audience can understand. You must sell to Carol, your ICP, which also means knowing exactly who Carol is.

- Too many things had to go right

- All startups have risks, and have potentially fatally large gaps with a high risk of not being solved. But some have too many gaps—too many things to go right simultaneously. If you have nearly all the requisite skills, if nearly all the objections customers have are addressed, if the market is healthy, if there are many possible distribution channels, if there are many possible niches, if more and more money is being spent in the market, then you should take a risk on the remaining gaps. But if all of those things are uncertain or are gaps that you know you’ll need some luck to overcome, then the probability that all of those things will break your way is near-zero, and you already knew that when you started. Your path should consist of “or’s,” not “and’s.”, so you can satisfy the Startup Drake Equation.

- Founders / investors broke up

- This can be bad luck, but you do pick your co-founders, and either you’ve known them for a while (in which case you made a poor selection) or you didn’t (in which case you made a rash decision). One reason why “break up” kills startups is that the departing founder left holding a huge amount of stock; the reason for that is there wasn’t a vesting schedule for all founders. That is a blunder. In any case, the team did it to itself—it wasn’t a competitor, or the economy, or the customers.

- Had no differentiation in the market

- This blunder is obvious from day one, when you had no idea why you were special, why the product is special, why someone should buy from you instead of someone else, why you’re the right person to build this company, why you will succeed in a space where many others have failed before. There are so many kinds of leverage you could have used, and you chose none of them.

“Tolstoy opens Anna Karenina by observing: ‘All happy families are alike; each unhappy family is unhappy in its own way.’ Business is the opposite. All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.”

Peter Thiel, Zero to One

- Refused to seek the truth / refused to see the truth / refused to learn

- We all have to force ourselves to see the truth, because the truth hurts. The truth is that our ideas weren’t right, our insight isn’t shared by customers, our awesome design is confusing, our potential customers love that competitor we’ve been calling “dumb,” that thing we say is “broken” is not in fact broken, the pain we insist our customers are experiencing, they’re not experiencing. Did you even ask? If you asked, were you listening? If you haven’t made major changes to your strategy and product and positioning, then you’re blundering. Seek the truth, then face the truth.

- Launching too early / Launching too late

- It’s funny that both of these are causes of failure. It’s a preventable blunder to launch with a crappy MVP instead of a simple but lovable v1. And because builders love only the building, they build for six months (or two years) without customers. Shipping crap, and never shipping, are both blunders. (P.S. Also, don’t “launch.” No one cares except your friends, and you’re going to have to reliably and consistently get customers for the next three years anyway, so just work on that.)

- Premature scaling

- Before Product/Market Fit, the job is to discover what works. What customers will actually pay for (and keep paying for a year later), what is the perfect, target customer and what do they want, how do you reach them through marketing and close them through sales (whether self-sold or human-sold), what you should charge and how. Many founders either don’t know what Product/Market Fit looks like, or don’t want to know, because they want to declare “I have it!” because it feels good to say and garners hearty congratulations and maybe a touch of envy on Twitter. But scaling is about doubling-down on what works—doing it more, faster, better, higher quality, more efficiently. Spending that time and money before you know what works, means wasting all that time and money. Then you run out of both. A blunder possibly of ignorance, but typically of putting ego before the truth.

- Selling to the Enterprise before $20M ARR

- If you’re targeting the Enterprise segment from day one, and you’re already built for the sales, enablement, onboarding, account management, legal, security, and product requirements, then this doesn’t apply to you. However, few startups begin there, exactly because of those heavy requirements. The common pattern is to have some success with the small or mid-market, then observe that “Salesforce bought some seats!” and decide to “go upmarket” because “we’re seeing signal that they need it.” There are always individual teams inside large companies who will buy your stuff—that’s good! But that’s different from targeting “the enterprise.” You probably don’t even know what you don’t know—a position of weakness that screams “bad strategy.” This is an easy blunder to avoid; take the orders from the teams, stick with the leverage you have, and don’t confuse a team using a tool on the side with what it takes to make multi-million-dollar top-down sales.

- Unworkable business model / cannot be profitable

- Unit economics can be measured right out of the gate. You already have a rough idea of the costs of production, and you know you’ll have to spend money and time on marketing and sales. Mismatching price to the business model by an order of magnitude is preventable. Many companies have no sensible business model even at scale. They say “we’ll figure that out later,” but that’s just admitting you’re blundering and hoping your future self will figure out how to stop blundering. Sometimes you will; if you don’t, whose fault was that?

- Writing code instead of winning customers

- After you have a working product in market, why aren’t you getting more customers? The builder says: Because I need more features. Or: Because the product has too many bugs. Both are incorrect; there are customers who need only the current features, but you’re not working on getting their attention with marketing, piquing their interest with the website, and winning their business with sales. And potential customers certainly aren’t ignoring you because your product has a bug—they don’t even know that yet. Coders like to code; everything else is hard, and not fun, and unclear how to execute, and costs money, and it’s so comfy to just sink back into the comfort of Visual Studio and marvel at the prescience of Copilot and tweak a CSS class. So people don’t find you, and don’t buy, and the company fails, because you blundered marketing and sales.

- Expanding the target market before winning the target market / moving too quickly to the second product

- I’m not here to call people out, so I won’t actually quote the many times I’ve seen someone on Twitter declaring that now that they’ve reached $2,700 in MRR, they are expanding into a new market segment. This simple blunder belies a lack of focus, a lack of conviction in the strategy, and lack of understanding that it is ten times easier to win another customer in your existing target market than it is to expand. This blunder dilutes your attention, marketing dollars, positioning, messaging, and product sharpness, and is easy to avoid. There is a time for expansion: Later.

- Lack of passion / endurance

- It is possible that there was passion at the start, but it evaporated, or there was an honest intention of spending the next ten years working on this mission, but you broke down. But that excuse is only valid if, on day one, you honestly took stock of what your passions were, what strengths you were going to leverage, understanding who you are, had a mission you deeply cared about (besides “make money” or “be able to say you’re a founder”), read about the emotional whiplash that startups always entail, and made the trade-offs against other important things in your life. If you didn’t do those things, it’s a blunder, not self-discovery. (If it really was self-discovery, you are forgiven, and more importantly, you should forgive yourself.)

In most cases, I’ve linked to specific ways to avoid each blunder. Which leads to the final point:

There is a way to build startups with lower risk, in large part by avoiding those blunders, which I’ve summarized in my Roadmap for Product/Market Fit.

Is this a fail-safe path? Of course not. Even in chess. The rest of the game does matter.

Still, when you can reduce so much risk by avoiding avoidable things, especially with frameworks that detail what “not blundering” looks like, why wouldn’t you do that?

80% winning is not blundering.

Addendum: External sources of “why startups fail”

CB Insights: From “111 interviews”

(Figure 2)

Figure 2

Paul Graham: The 18 mistakes that kill startups

- Single founder (as opposed to having a co-founder)

- Fights Between Founders

- Bad location

- Marginal niche

- Derivative idea

- Obstinacy

- Hiring Bad Programmers

- Choosing the Wrong Platform

- Slowness in Launching

- Launching Too Early

- Having No Specific User in Mind

- Raising Too Little Money

- Raising Too Much Money

- Poor Investor Management

- Spending Too Much

- Sacrificing Users to (Supposed) Profit

- Not Wanting to Get Your Hands Dirty

- A Half-Hearted Effort

Tom Eisenmann: Why startups fail, from hundreds of interviews and surveys

- Good Idea, Bad Bedfellows (not just founders, but investors, key executives and employees)

- False Starts (not researching enough before starting or MVP—customers, competitors, market)

- Maintaining Balance (managing psychology and maintaining a healthy determination)

Steve Blank: 9 Deadliest Startup Sins

(You can see Lean Startup screaming out of these: Answers are outside the building, not in your head, now seek it and iterate.)

- Assuming you know what the customer wants

- The “I know what features to build” flaw

- Focusing on the launch date

- Emphasizing execution instead of testing, learning, and iteration

- Writing a business plan that doesn’t allow for trial and error

- Confusing traditional job titles with a startup’s needs

- Executing on a sales and marketing plan

- Prematurely scaling your company based on a presumption of success

- Management by crisis, which leads to a death spiral

John Osher: 17 common mistakes from consumer products

(Many are variants of “scaled too quickly” or “spent money ahead of need.”)

- Failing to spend enough time researching the business idea to see if it’s viable.

- Miscalculating market size, timing, ease of entry and potential market share.

- Underestimating financial requirements and timing.

- Over-projecting sales volume and timing.

- Making cost projections that are too low.

- Hiring too many people and spending too much on offices and facilities

- Lacking a contingency plan for a shortfall in expectations.

- Bringing in unnecessary partners.

- Hiring for convenience rather than skill requirements.

- Neglecting to manage the entire company as a whole.

- Accepting that it’s “not possible” too easily rather than finding a way.

- Focusing too much on sales volume and company size rather than profit.

- Seeking confirmation of your actions rather than seeking the truth.

- Lacking simplicity in your vision.

- Lacking clarity of your long-term aim and business purpose.

- Lacking focus and identity.

- Lacking an exit strategy.

Andrew Montalenti: (founder of Parse.ly) Common startup mistakes

- Marriage trouble

- No bootstrapping plan

- Startup as a career move

- Refusal to change the original idea

- Preemptive scaling

- Growing too fast

- Scared of code

Forbes

- Not in touch with customers

- No differentiation in the market

- Failure to clearly communicate value propositions

- Leadership dysfunction, especially founder strife

- Can’t find profitable business model

https://longform.asmartbear.com/avoid-blundering/

© 2007-2025 Jason Cohen

@asmartbear

@asmartbear Simple eReader (Kindle)

Simple eReader (Kindle)

Rich eReader (Apple)

Rich eReader (Apple)

Printable PDF

Printable PDF