Selling to Carol: Why targeting an ICP brings 10x more customers than you expected

Selling to everyone means selling to no one

Everyone goes to your home page, therefore your home page has to speak to everyone, right? Buyers, users, existing customers, curious explorers, all working at companies large and small.

Most companies approach this the wrong way, which is to speak to “everyone.” The worry is, if you were to speak only to a narrow customer segment, everyone else feels excluded or confused, and will bounce off the home page and buy something else. So you end up with generic positioning statements like “The Power To Know.” (Figure 1)

Figure 1: SAS is The Power To Know®, but know what exactly?

SAS has trademarked “The Power To Know®” but I’m not sure why. Can you tell me what the product does? Who it’s for? Did you read that entire paragraph? Surely not.

Could anyone in the world—even their perfect, ideal, best customer (ICP: Ideal Customer Profile)—be intrigued and excited to learn more? If that ICP happened across the website, would they even know they are the ideal customer?

The first step in disabusing yourself of this fluffy language is to see that by not speaking to a specific customer, you’re saying nothing to everyone and thus everyone will bounce off the home page, and never think of you again. (You didn’t give them anything to think about.) If your ideal customer doesn’t know you’re selling to them, who will?

By the way, The Penny Group also delivers “The Power To Know®,” also trademarked (Figure 2). So much for defensible differentiation through trademarks.

Figure 2: So much power! So much knowing!

Generalized messaging has no power, no emotional connection, no interest, no information.

Exactly the opposite of what you need from your advertising or home page.

The next step in disabusing yourself of this idea of “speaking to everyone” is to acknowledge that it is impossible to speak to everybody at once. You want software developers to know you have an extensible API, but you want the corporate buyers to know that your product makes them more money. You want to look professional so that managers at large companies are comfortable trusting your company, but you don’t want to so aloof that small company buyers see you as “too corporate” and can’t relate. You want to highlight configurable workflows and reports that allow large customers to apply your tool to all their teams, but you want small customers to realize that you can turn all that off so things are simple and easy.

Once you agree with these two points—you must be evocative and specific, and you can’t speak to everyone—you must conclude that you have to speak to just one type of customer.

But how do you pick, and how you avoid excluding everyone else, reducing your target market to a tiny niche?

We’ll start with the first question.

Selling to Carol

Describe a perfect customer. We’ll call her Carol. Pick a concrete company that she works for, a company similar to one of your existing, thrilled customers. What’s her official title and what does she do? If your potential market includes a wide variety of company types and positions, just pick one in particular. Whatever problems your product solves, Carol has all those problems. She has all the problems, she knows she has the problems, she already has the budget to spend on those problems, and she’s already looking for how to spend it, just like it says in your market analysis. Write those problems down from her point of view, the way she would describe them if complaining to a friend over lunch. Whatever advantages you have over your competitors,1 Carol needs exactly those things. Whatever makes people love you,2 Carol has those attributes. Whatever makes people continue paying for the product forever,3 Carol has that. List all these things.4

Carol is literally custom-built to be blown away by your product.

1 Not sure? Ask your Sales team—they’ll tell you, “oh yeah, any time someone says ______, I know we’re going to close the sale.”

2 Not sure? Ask your Support team—they’ll tell you, “oh yeah, the best people are ______ because they ask great questions and they’re always telling me how much they love us, even when they have a problem.”

3 Not sure? Look at your retention data—which customers stay forever, even if you think they shouldn’t? Not sure about that either? Use the Iterative-Hypothesis method to interview them—you need to do that anyway so you can build great products.

4 Some pundits recommend inventing a personal back-story like “Carol has two cats and loves Mahler.” Don’t do that. It’s irrelevant and inaccurate. Stick with professional attributes, what Carol is interested in, why she is interested in it, why she is looking for a new solution right now, how she makes those decisions, what her budget is, and so on, all topics listed in the aforementioned Iterative-Hypothesis method.

Now the question is: What would a web page / Google ad / print ad / trade-show booth / postcard be like, such that Carol would immediately understand that you are her savior? Remember, you get only 3 seconds to grab her attention and another 5-10 to convince her that your product is the second coming.

Can you make it clear in a picture? Maybe a before/after she can relate to? Will describing three features make it plain? Will pointing out your best competitive advantage make her weep for joy in finally finding a company who “gets it?” Can you ask a provocative question, something she identifies with? Is there a phrase where she’d laugh out loud because “that’s so true?”

You only get a few seconds, so a paragraph won’t do. You have to communicate in a picture and a few words. The good news is you have to please only Carol, and you know Carol. You even know she’ll honestly be thrilled to find you.

If your ad can’t grab Carol’s attention—your perfect customer—why do you think it will grab anyone else’s attention?

If you still say it’s impossible to communicate your message in 5-10 seconds, no one in the world will get your message. Simplicity is as important in positioning as it is in strategy generally.

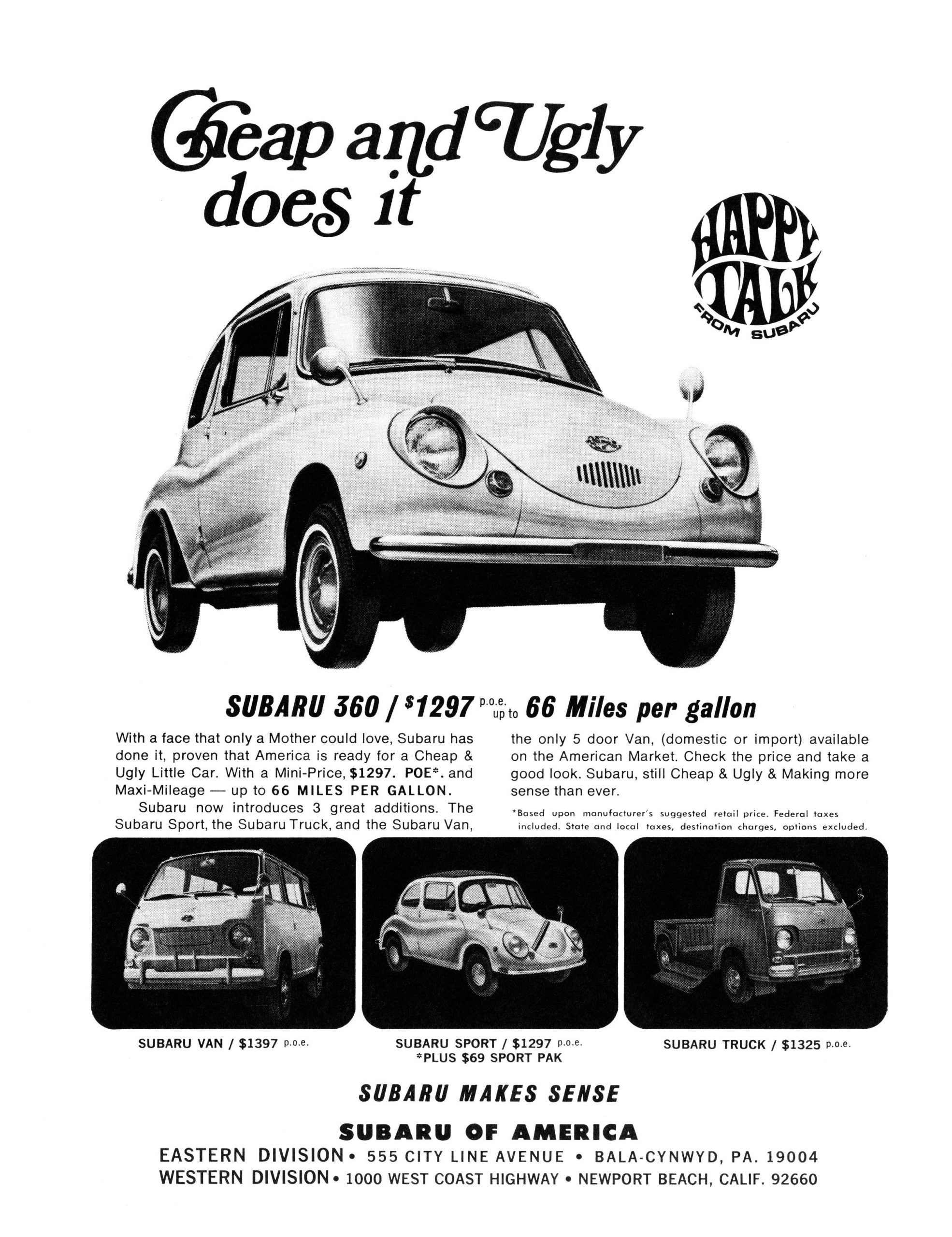

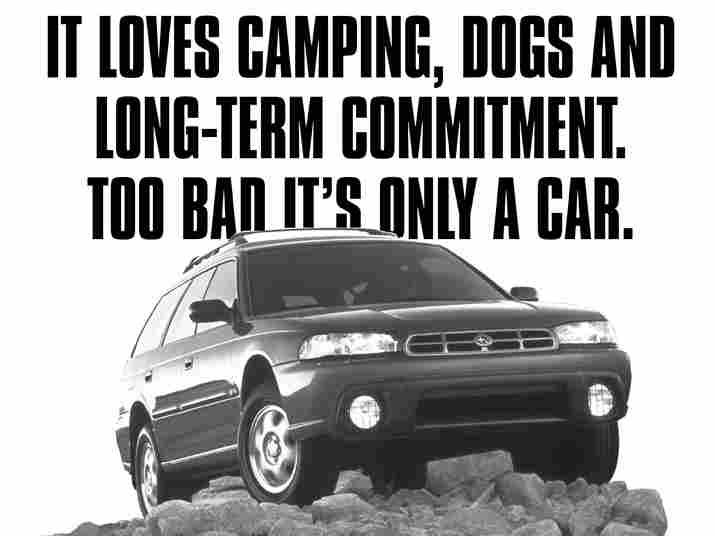

When you’re willing to speak only to your target audience, it is incredibly powerful (Figure 3) (Figure 4) (Figure 5) (Figure 6) (Figure 7).

Figure 3: Twilio targets developers, even though the buyer isn’t a developer. This campaign was so effective, it turned into an entire book.

Figure 4: Dollar Shave Club was unabashedly “cheap but good,” and didn’t care about sleek advertising like Gillette. It got everyone’s attention because it was such a clear message, and sold razors to everyone, not cost-conscious consumers only.

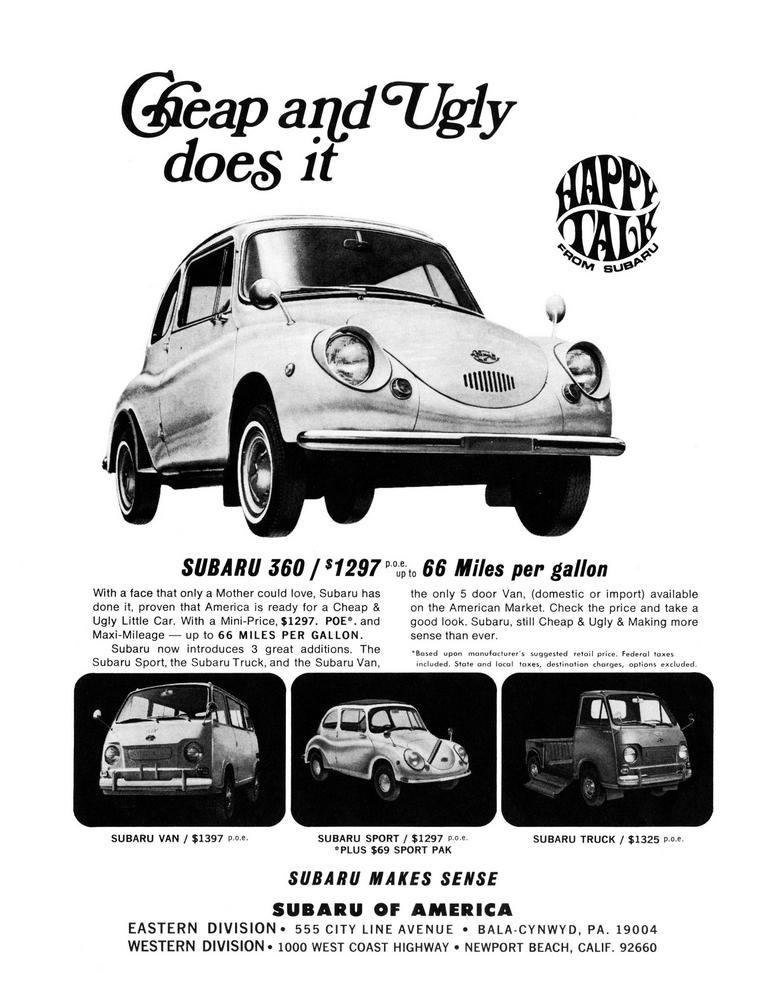

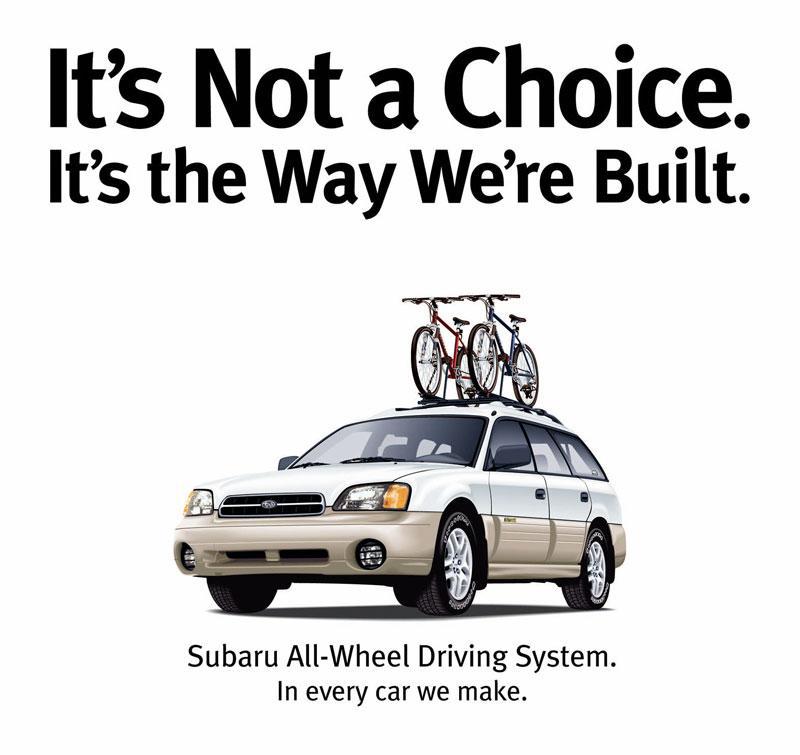

Figure 5: Subaru knows it isn’t cool; it highlights its positive attributes.

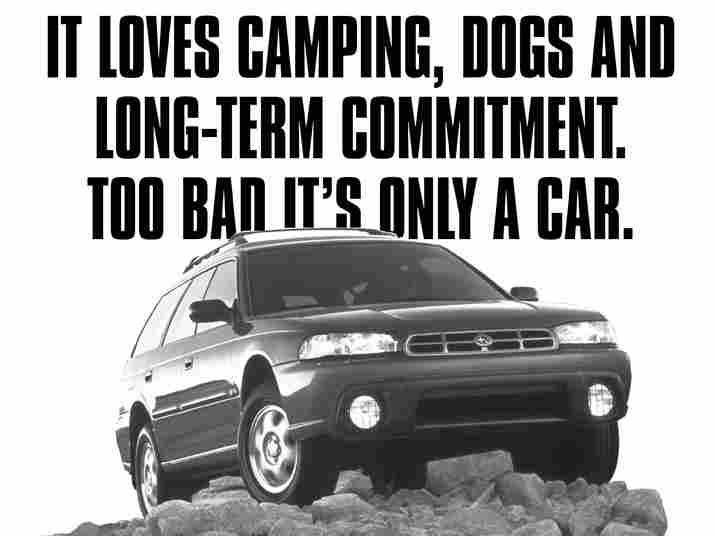

Figure 6: Subaru is about accessible, safe family life.

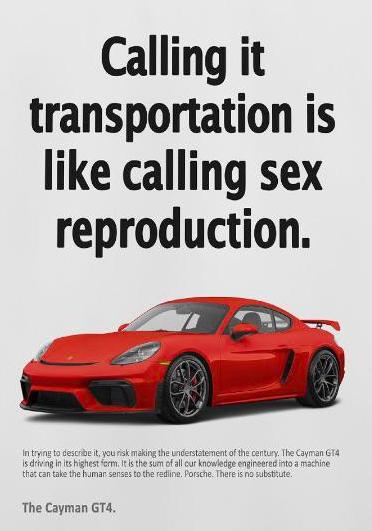

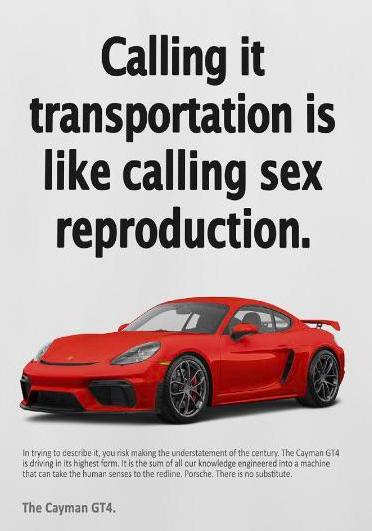

Figure 7: Porsche’s message is… differentiated from Subaru’s.

Surprise: You’ll automatically sell far beyond Carol

Now let’s tackle the fear: That targeting Carol means you’re excluding the rest of the market, and therefore limiting your growth and reach, even if you perform well in your niche.

That’s not what happens. Here’s what actually happens:

You have a target market—the bullseye—and the center of that bullseye is Carol:

Figure 8

Every product has strengths and weaknesses. For Subaru:

| Strengths | Weaknesses |

|---|---|

| • Low-cost • Reliable • Safe (top-rated by government) • Rugged (take it off-road) |

• Low performance • Not sporty • Not cool • Ugly |

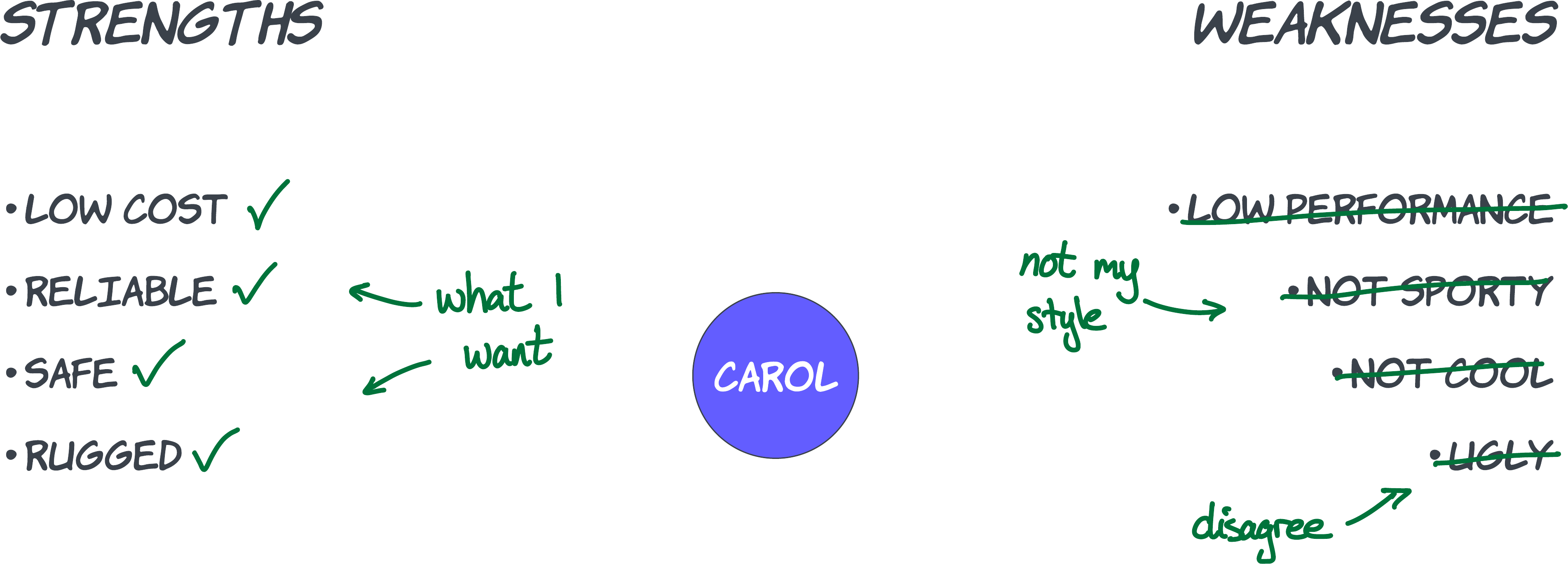

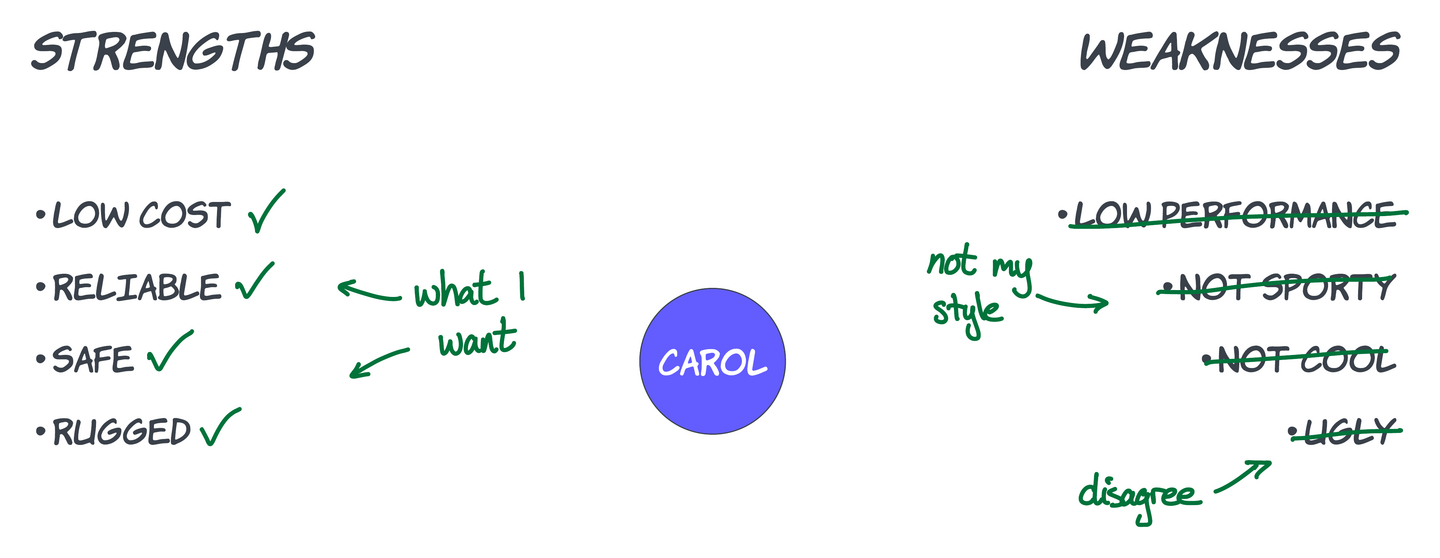

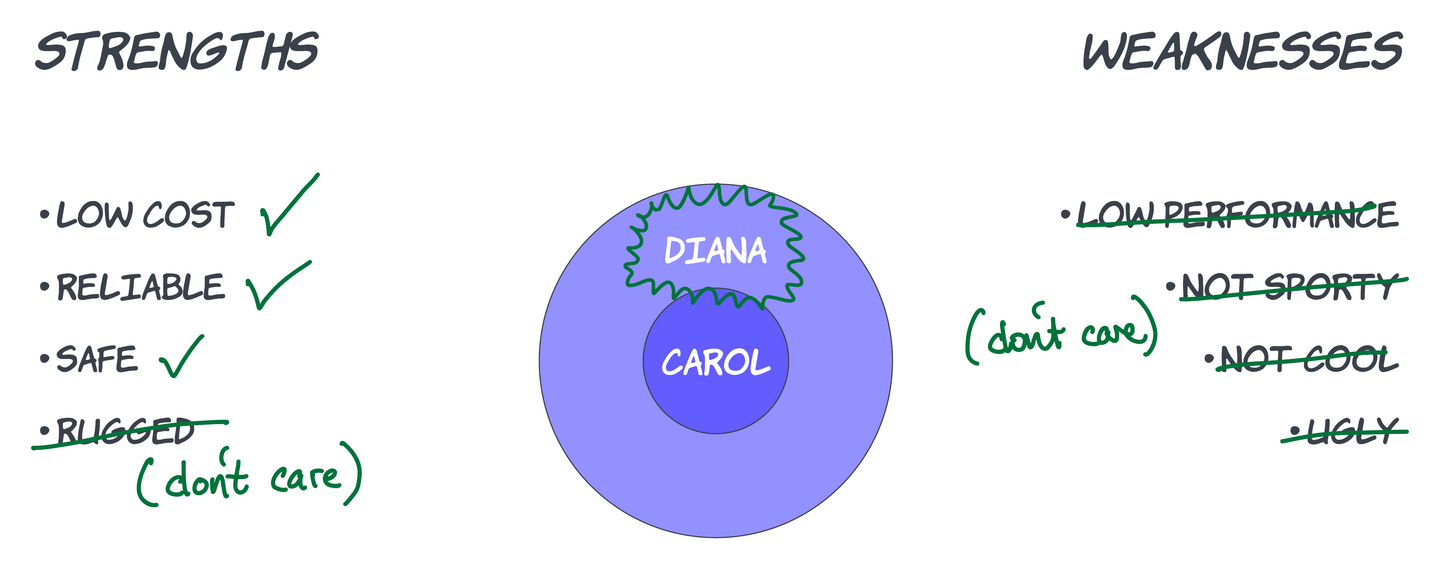

Carol is constructed such that she values everything on the left, and actively does not want anything on the right. To her, those aren’t weaknesses, those are actually strengths, because she wouldn’t be caught dead in a Porsche, her lifestyle isn’t sporty, and she disagrees with your definition of “cool” and “ugly.” (Figure 9)

Figure 9: Carol’s preferences

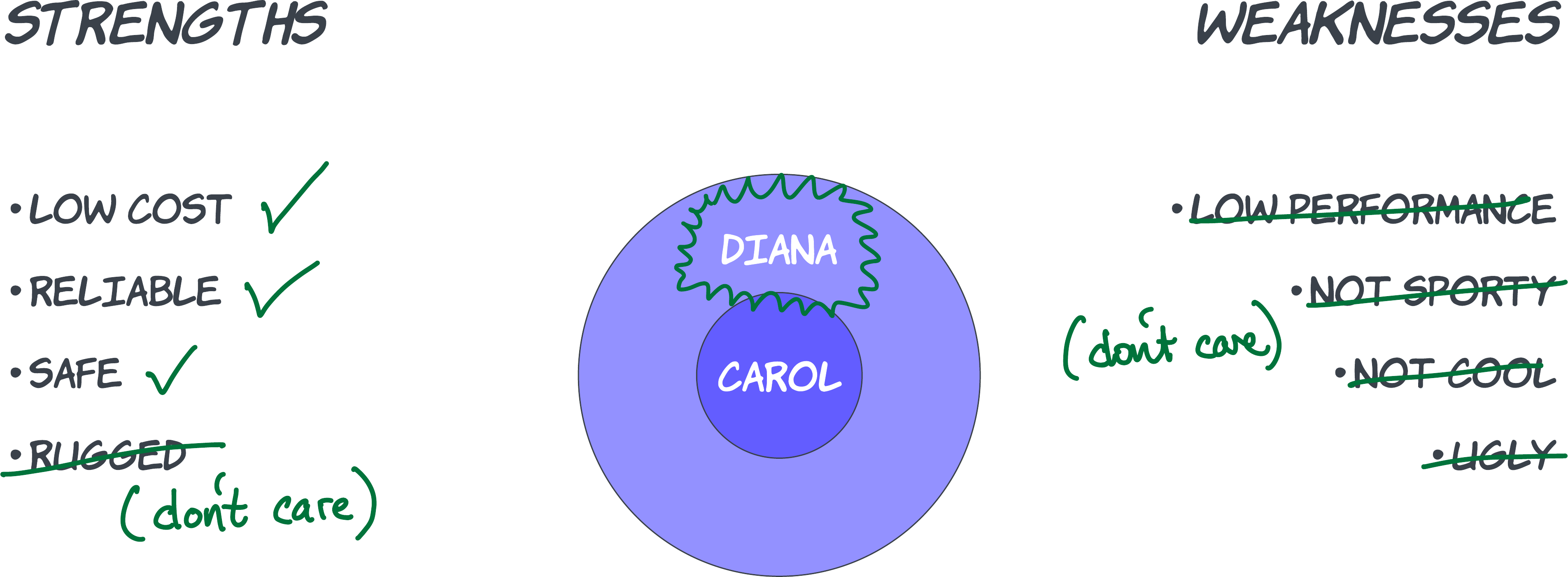

But Carol isn’t the only person attracted to this set of trade-offs. There are other people who either like the things on the left or are at least indifferent to them, and are indifferent to the things on the right. For example: I drive my daughter to school, drive to work, and spend a lot of time on highways and residential roads, so I want something safe and reliable, and I don’t care about high performance or being sporty.

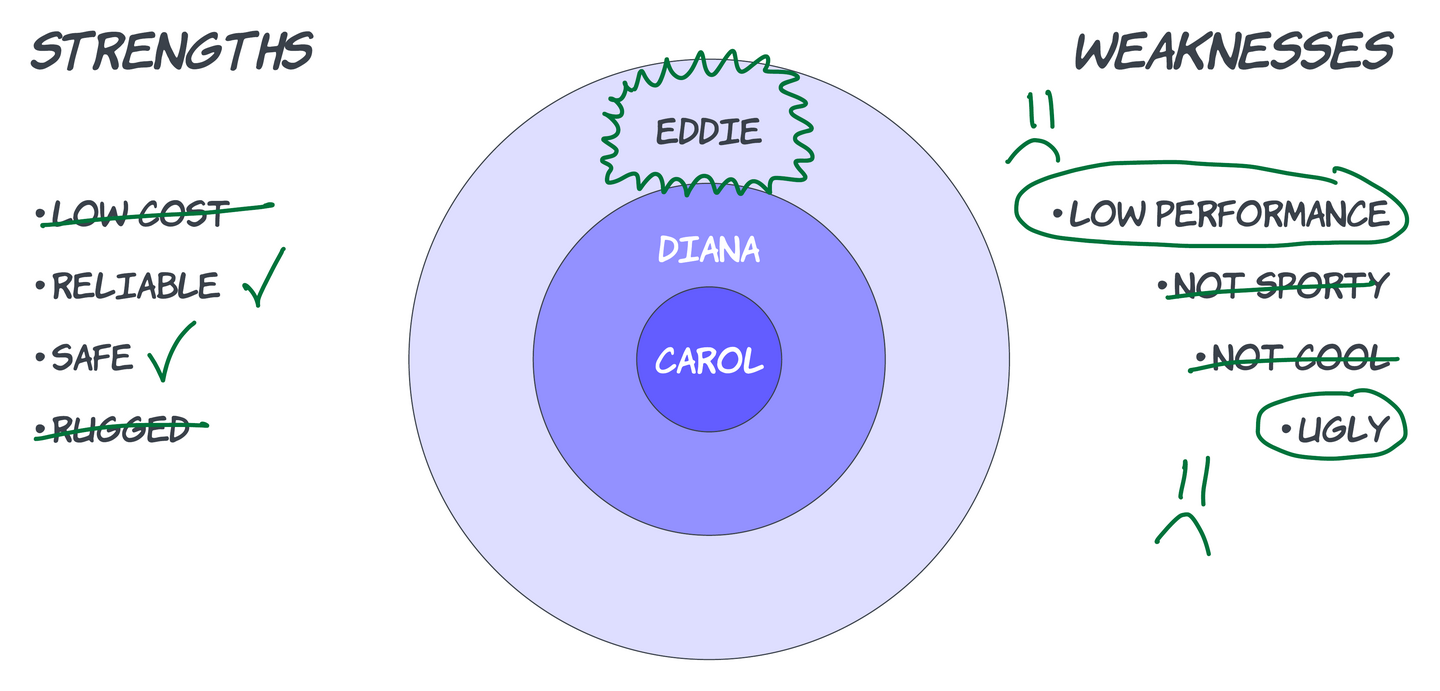

That’s the next ring in the bullseye—people who generally value your positives and aren’t dissuaded by the weaknesses. There are 10x more of those people than there are of Carol. Let’s call that person Diana:

Figure 10

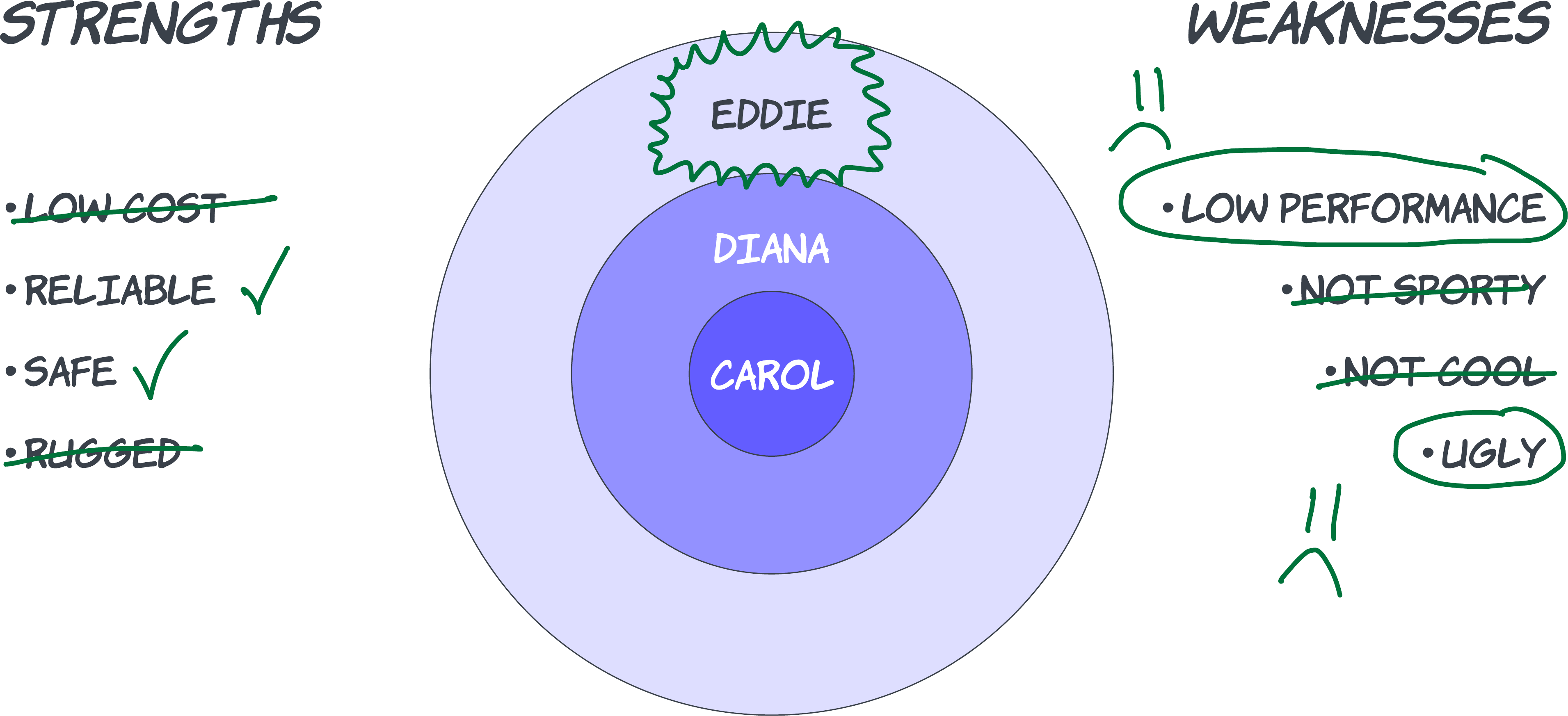

But that’s not all. Buying a car—or anything—is always a set of trade-offs. You rarely find a product that fits your preferences perfectly, i.e. you’re rarely The Carol for any product (or even The Diana). So, you weigh the pros and cons. Maybe I don’t care about being rugged because I don’t go off-road, but I do care about safety and reliability, and I’m neutral on cost. And on the weaknesses, I’m disappointed that it’s low-performance, and I do care what it looks like. But, I don’t care about “sporty” or “cool” specifically.

So where does that leave me? Who knows—everyone will weigh these things differently. Clearly some of those people will still consider the Subaru to be the best-possible set of trade-offs, and there are 10x more of those kinds of people than there are of Diana. Call them Eddie:

Figure 11

This is why, contrary to your fear that targeting Carol dramatically limits your target market, your effective target is actually at least 10x larger (because of Diana) and more like 20x-100x larger (because of Eddie).

Targeting Carol makes your message clear, compelling, evocative, even emotional. But trade-offs are how people buy, and exactly because you were so clear about what those are, you’ve paved the road for many people to make that choice.

Does this theory work in practice?

Continuing the Subaru example,5 the advertisements above are about being low-cost but practical. These are attributes valued by many people. But in the 1990s, sales were in decline, so they researched which consumer segments were most likely to buy a Subaru. They found five categories: Teachers, healthcare professionals, IT professionals, “outdoorsy types,” and lesbians. Lesbians were the strongest category—four times more likely to buy.

5 This story is expanded and cross-referenced in Alex Mayyasi’s 2016 article in Pricenomics.

Targeting lesbians was a risky move in the ‘90s. There were still no mainstream TV shows or movies with gay characters, and celebrities were still in the closet. When Ellen DeGeneres (both a celebrity and star of a popular TV show) came out as gay in 1997, advertisers pulled out, including Chrysler. When Ikea ran a commercial featuring a gay couple, their stores received bomb threats.

But as Warren Buffett says, “Be greedy when others are fearful,” and Subaru invested where others feared to tread (Figure 12) (Figure 13).

Figure 12

Figure 13: Twenty years before Lady Gaga’s “Born this way.”

The campaigns were a hit, but not only with lesbians. Subaru grew faster in the subsequent ten years than any other car company,6 and while the gay and lesbian demographic remained their strongest niche, the vast majority of people who bought a Subaru were straight. And they were buying the car because they value its attributes—affordable, safe, rugged—and because on balance they cared more about those than the attributes it lacks—sleek, sporty, high performance.

When you target Carol, your positioning is strongest, and you win where you deserve to win. But far more people will buy because they have similar purchasing preferences.

6 Measured as a percentage of total sales volume from 1995 to 2005, of car companies that were founded before 1990.

Finding Carol in the noise

When a customer cancels, we need find out why—what did they think would happen, and how did we fail them? Unless the customer stopped their project or went out of business, cancellation indicates a gap between what we promised them (marketing) and what we delivered (product).

This investigation is most urgent when the customer is Carol. You stipulated she is the perfect customer, but she disagrees. Perhaps the product needs to change, but perhaps your definition of Carol needs to change to better match what the product has turned out to be or what you are uniquely excellent at delivering, or some other facet of your strategy.

The same could be said Diana, but when it comes to Eddie it’s less clear whether this is signal or noise. Eddie is a mismatch for some of our attributes, and might cancel as a result, but that doesn’t mean we should change those attributes, if they align with Carol and Diana. If we treat all customers as if they are Carol, and therefore all cancellation data as a vital signal, we lose track of building for Carol and we end up building for nobody.

Some customers aren’t even Eddie—they’re not on the bullseye, yet they signed up. You might think this would be rare, since it is irrational, but in fact it will happen all the time. You need to identify these customers and completely ignore their data—the noise will push you off course.

Therefore, you need a way of identifying who is a Carol. Ideally, right from the start, during on-boarding, maybe with a few questions, maybe based on activity indicating they’re in that perfect zone. Then, you can measure cancellation rates of Carol (the only rate you care about), and spend extra time finding out why they cancel. The “extra time” comes from the time you saved by not pursuing and interviewing other customers.

Prioritizing Carol over revenue

Of course it’s not just in cancellations that you want to segment the ICPs from the rest of the customers. It’s in your activation funnel. It’s in your trial or freemium conversion rate. It’s in individual feature usage. It’s in conversion to monthly active users (meaning a single user actually using it consistently month over month). It’s in tech-support requests both for bug fixes and features. It’s in every aspect of understanding how customers are intersecting with our product and company. It’s always about the Carols; everything else is noise, and if you don’t separate the two, you can’t build the best product, for any definition of “best.”

The typical failure mode for this is that your biggest customer, who you desperately want to keep because you really want that revenue, occupies you constantly in tech support and in feature requests, some of which you’ve implemented just for them, with the internal excuse that “if they want it, other larger customers probably will want it, so this is a path of growth,” yet they’re still perennially unhappy, unsatisfied, obviously a bad fit, an anti-Carol, but dangit you need that money and if we can just make this work there must be more customers like that coming.

And after all that, of course they leave in a huff, having been incredibly unprofitable despite their high nominal revenue, and you should turn around and say, “Wait a minute, that customer was not in our bullseye all along.” Rather than noticing that from the start, and helping them to leave your company, you clung to them because you so desperately wanted it to work, and for good reason—it was a lot of money—but ultimately that wasn’t the right reason, and the whole thing was an enormous waste of time. You could have been finding and on-boarding a few more Carols instead, and they would still be here, happily paying you money, profitably.

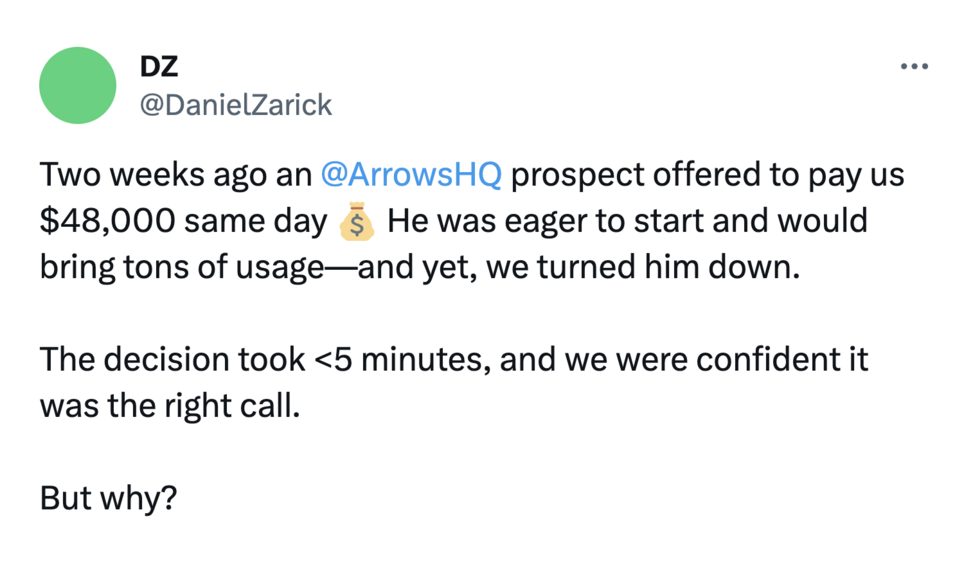

You’ll know that you’re doing this right when you turn down a sale, even though it would have been your largest customer, simply because they’re not your ICP, as in these miniature stories from Daniel Zarick at ArrowsHQ and John Doherty at EditorNinja. This separates first-time founders from seasoned founders. It’s not a coincidence that both Daniel and John have seen this movie before, made this mistake before, and are avoiding it this time.

Can you?

After all this, if you reread that ad from SAS with The Power To Know®, you’ll die a little inside. So much nothing. Nothing to say, said to no one, caring about nothing, changing nothing, being nothing.

You can do better.

And make more money doing it.

Many thanks to Florian Caeser for contributing insights to early drafts.

https://longform.asmartbear.com/icp-ideal-customer-persona/

© 2007-2025 Jason Cohen

@asmartbear

@asmartbear Simple eReader (Kindle)

Simple eReader (Kindle)

Rich eReader (Apple)

Rich eReader (Apple)

Printable PDF

Printable PDF