Sometimes never compete on price

“Never compete on price.”

So we are told. But customers want low prices, and it worked for Costco, Southwest Airlines, Vanguard, IKEA, Amazon, Walmart, McDonald’s, H&M, Dollar General, TJ Maxx, and many others. So why are we told not to use a low-prices to win?

When two products are fundamentally different—in features, integrations, complexity—customers often have no real choice between them. A large enterprise must use software with single-sign-on, security controls, compliance features, and the ability to scale to tens of thousands of users with roles and permissions and integrations with corporate systems.

For a small business, those features make the software harder to use. And no one wants to pay for things they don’t need. So, Enterprise- and SMB-targeted products differentiate on capabilities and user-experience, not on price.

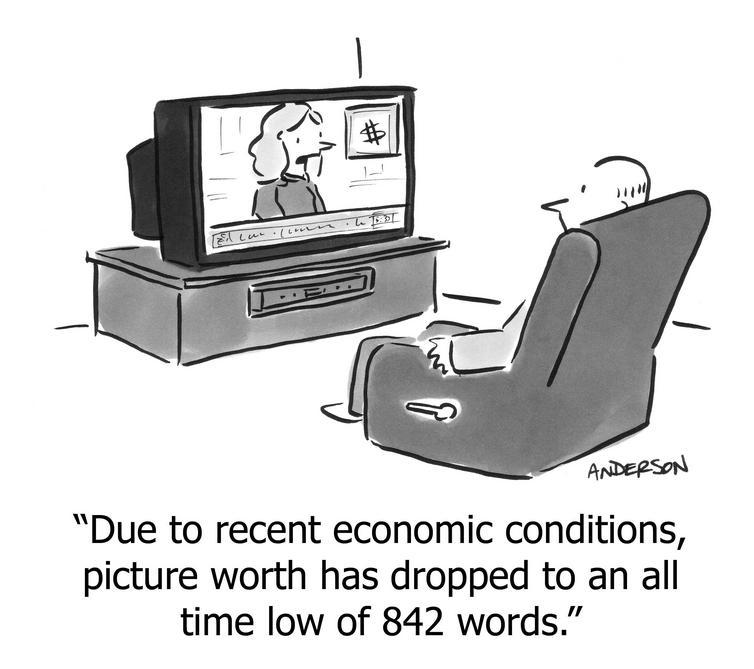

But consider two products that solve the same problem for the same customer segment in largely the same way, with largely the same features. The sales team highlights minor differences that matter to maybe 10% of users. Each founder is certain that theirs is the Only True Way, but everyone else has a hard time distinguishing them. Price, then, is the last remaining thing they can compete on. They are two gas stations across the street from one another; the main difference is the number on the big sign.

So, one company drops its price by 20%, and starts winning market share. The other, having no other way to compete, does the same. This continues through “special offers” and permanent cuts and “branding” and kick-backs to influencers until there’s no profit left. Both companies end up poor, and in case your response is “Good! Companies are evil and don’t deserve profits!”, remember this also means they’re unable to invest in product development or customer service; thus the products and companies stagnate and then deteriorate, which in turn ruins the customers’ experience. Low price comes at a price, to consumer and company alike.

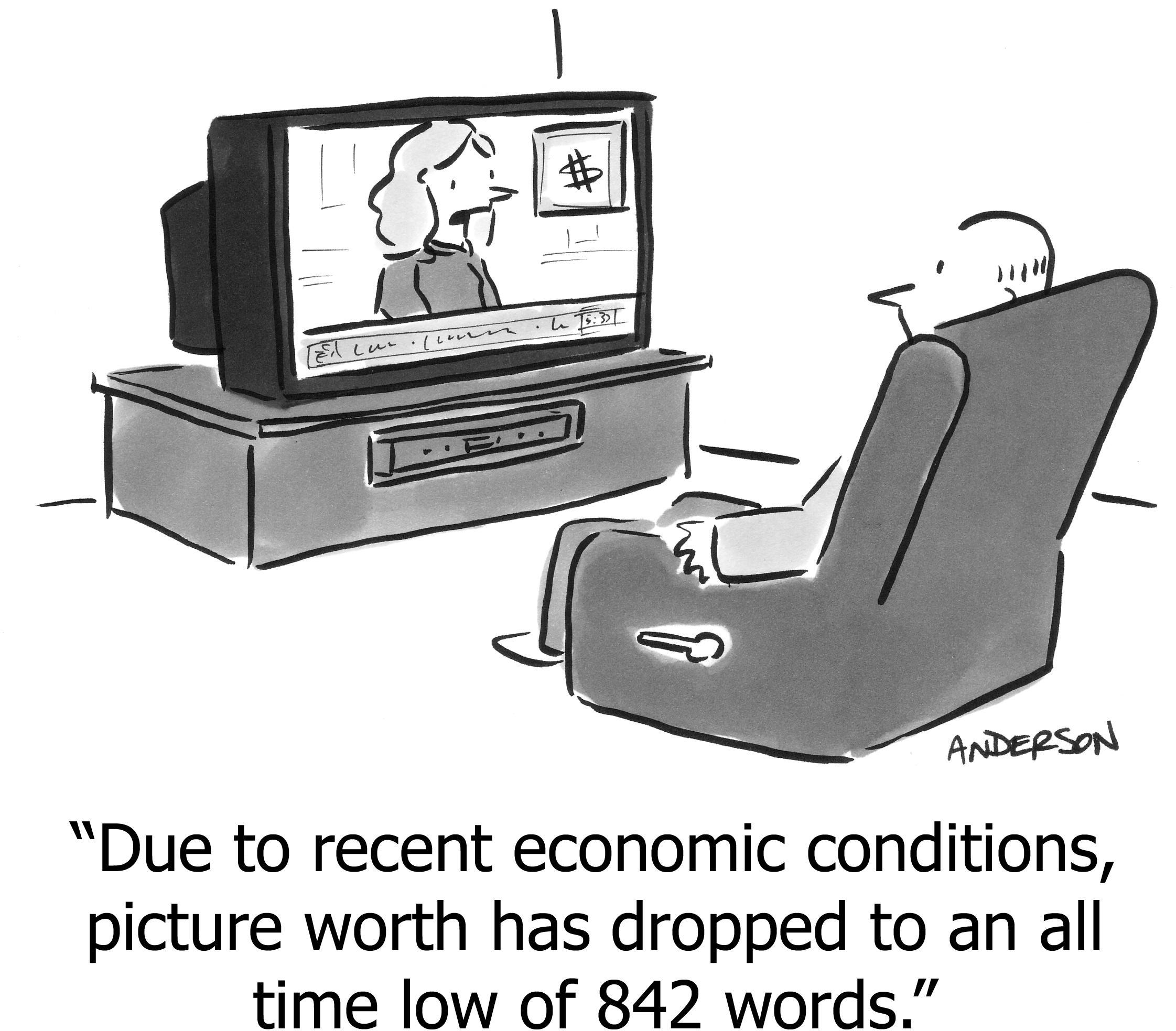

The math is even worse. A 20% price cut needs a 25% increase in number-of-customers to maintain the same amount revenue.1 It’s worse again with profit; even a seemingly-minor 10% price reduction can easily mean a 50% profit reduction2—terrible!

1 Charging 80% of the price at 120% purchase volume multiplies to 96% of the revenue you had. Percentage losses always require even-larger-percentage gains just to get back to where you were. This asymmetric effect also appears in the math of becoming more productive.

2 Suppose the company charges $100 for a product and makes $20 profit after all costs. Reducing the price to $90 (a 10% price reduction) reduces profit to $10 (a 50% reduction from $20). This is exactly why established companies cannot compete on price on their main product, and thus is an Achilles’ heel for startups to exploit.

This math is why pundits (including me) constantly admonish bootstrapped founders to “raise your prices.” Low prices leave room for neither reinvestment nor profit. New founders price their products low for the wrong reason: They don’t know how to set prices, and they know their initial product isn’t very good, so instead of making it simple and lovable and winning a reasonable price from their ideal customers who would be happy to pay it, they sheepishly charge a low price, attracting the worst kinds of customers (the ones who can’t afford a proper solution, but occupy the greatest amount of time in tech support), and dramatically increasing the number of customers they must accumulate before they can quit their day job, all with no extra money for marketing or sales or design or product development. This is the wrong decision, made in fear and ignorance.

So, is it true? “Never compete on price?”

Well, no. Of course it can be an excellent strategy to have the lowest prices.

There are many examples of wonderful companies, with amazing products and happy customers, and even happy shareholders, with profits, growth, and longevity, where “low prices” is a critical strategic component.

Jeff Bezos famously quipped: “Your margin is my opportunity.” Meaning: While a competitor is extracting profit from some product, Amazon will sell the product cheaper, which either means stealing market share (if that competitor stubbornly maintains its price) or destroying the competitor’s profit (if that competitor matches Amazon’s price).

But why doesn’t this run into the problems we just outlined? Why is this smart for Amazon, but dumb in our hypothetical commoditized-market example?

Low price as a complete strategy

The difference is that successful low-price strategies treat price as just one component of a comprehensive strategy to win. A strategy with unique, interlocking, self-reinforcing decisions, where “lowest price” was an outcome of the decisions, not a tactic thrust upon them by the competition, not their last-ditch effort to win a sale.

Those decisions created negative consequences also, that many potential customers hate. Great strategy requires strong decisions, which means trade-offs. They created greatness in some areas by leveraging specific weaknesses in others. In doing so, they created a strategy that others wouldn’t (and didn’t) copy, not because no one wanted to copy their strengths, but because they weren’t willing to copy their weaknesses, which enabled those strengths.

These unique trade-offs resulted in a unique product, and although some consumers hate it, many love it. For some, it is the ideal product; for 100x more, it is not ideal, but it is a better set of trade-offs than the alternative. When you dare to trade off, you dare to sell to a subset of the market, but then you win, and you win more than the small “ideal” subset that you targeted.

Let’s examine some examples of interlocking, weakness-leading-to-special-strength low-price strategies.

- Costco

- By coupling higher quality products together with higher quantities in each purchasable package, Costco’s unit price is lower than grocery stores. Consumers are thrilled to get a deal for something “this good.” A store that caters to bulk-buying can also get away with a “warehouse” feel, which means spending less on the interior. Bulk-buying also means they don’t need to stock all the goods that a daily grocery store must; this gives them inventory flexibility. These lower costs yield lower prices while also yielding profit. Because other grocery stores can’t match these qualities, Costco stores remain unique.

Notice the drawbacks: Unappealing interior, limited scope of inventory, and on top of that, they require an annual membership fee! The fee, by the way, is pure profit, and increases how often a consumer comes back to the store.

Furthermore, to maintain their brand as the low-cost leader, the store has a strict 14% margin cap on all products. This is a clear financial penalty, especially when customers would be willing to pay more—but again this interlocks with their brand promise.

Defying more industry “wisdom,” Costco is well-known for treating employees particularly well, including an average $24/hr wage that is typically double what grocery and retail pay in the same cities. This decreases turnover and increases productivity, which again contributes to profits and a great customer experience. If only all grocery stores would realize the wisdom of this strategy.

Thus, interlocking decisions about employment, quality, package-sizes, inventory, store-constructions, and membership, yields “low prices” as an outcome.

- Southwest Airlines

- Southwest Airlines has been a low-fare powerhouse for 50 years, yet remained profitable even during the US terrorists attacks of September 2001 and the recession of 2008. Every other major US airline filed for bankruptcy at least once, but not Southwest. Yet Southwest consistently has extremely cheap tickets.

Like Costco, they made interlocking product and operational decisions that generated this result. They shuttle back and forth many times per day along the same few, short routes. Already there’s a negative trade-off—no long hauls, no international—but also positive ones—frequent flights means consumers have better schedules and it’s easier to “catch the next flight” if needed. They don’t interconnect with other airlines, won’t transfer your bags, and they fly into secondary airports where major carriers don’t operate—more negative trade-offs, but secondary airports are cheaper, so fares can be lower. Other airlines have many kinds of airplanes to support many kinds of routes, but Southwest uses only one type of airplane; this gives them pricing power over the supplier (due to large orders), and is cheaper to maintain (mechanics need only a single set of tools, single set of spare parts, and single training program), reducing costs again. They have no amenities—no 1st-class seating, no meals, no support for travel agencies—which again is a negative trade-off for some consumers, but lowers costs and therefore supports lower prices.

This strategy was so effective—and so well-studied—that it gave rise to a whole sub-category—the so-called “low-cost carriers” that includes JetBlue, Spirit, and Frontier. None were as successful, two of the three went bankrupt, and none impinged on Southwest’s profits, demonstrating that great strategy works even in the face of competition that is expressly “copying you” to replicate your success.

- Vanguard Funds

- Every large mutual fund conglomerate in the late 1970s included hefty operational fees that paid the salaries of fund managers and analysts who researched stocks and decided when to buy and sell. Consumers paid around 2% per year to have these managers vigilantly generating insights and taking actions on their behalf. If the fund increased in value by 5%, the consumer would receive only a 3% increase. It really hurts if the fund decreases in value. Most funds still operate this way today; even VC and PE funds typically have a 2% annual management fee.

Vanguard realized that many people might want a completely different product: One that simply tracks indexes like the S&P 500, or automatically (i.e. without human judgment) tracks well-defined sets of stocks like “Large American companies.” Without teams of human beings, they could eliminate the 2% management fees and expense ratios, replacing it with de minimus fees from automatic trades. For consumers who believe that fund managers outperform the market, this new product was silly. But for consumers who believe that managers don’t out-perform the market in the long run—especially after removing the compounding effect of fees—the Vanguard funds were uniquely low-cost. Again, “low cost” was an outcome of a unique product, that made different trade-offs, that was appealing only to a subset of the market.

- IKEA

- IKEA revolutionized furniture retail with a comprehensive strategy where every decision reinforces low prices. The foundation: Forcing customers to assemble their own furniture. Often poorly, frustrated, and complaining.

This seemingly simple decision created a cascade of advantages—flat-pack furniture dramatically reduces shipping and storage costs, allows for more efficient store layouts, and minimizes damage during transport. Their unique showroom-to-warehouse flow, where customers navigate a single path through inspirational room setups before collecting their own items, both enhances the shopping experience and reduces staffing costs. The globally standardized product line means they’re not creating custom products for each market. These decisions come with clear trade-offs—furniture that isn’t heirloom quality, the notorious assembly experience, limited selection within categories—but for price-conscious consumers furnishing their first apartment or dorm room or spare bedroom, IKEA’s system delivers remarkable value. The low price isn’t a tactic; it’s the natural outcome of a thoroughly designed system.

Low-cost strategies don’t always require significant financing

The modern SaaS playbook dictates that “low price” strategies require raising tens or hundreds of millions in venture capital. The playbook is logical: Low-price business models are profitable only at scale—when revenue finally outgrows the overhead of people, suppliers start providing bulk discounts, sales and marketing costs amortize over enough customers, and so on.

Logical though it may be, it is not the only playbook. All four of these iconic, multi-billion-dollar low-price leaders thrived with remarkably modest initial financing.

Costco’s first warehouse opened in 1983 at a cost of $5M, and went public in 1985 with a small $30M offering. Costco’s model was profitable almost immediately—the membership fee revenue covered most of the fixed costs, allowing them to operate on razor-thin product-margins from the beginning. Their expansion was largely funded through operational cash flow rather than massive external financing rounds.

Southwest’s initial financing was remarkably modest for an airline. Founded in 1967, they started with $560,000 in initial capital. They began operations in 1971 with just three aircraft serving three cities. Southwest’s ability to turn a profit quickly allowed it to fund most of its expansion through earnings rather than heavy external financing.

Vanguard was created in 1975 with an initial capitalization around $2M. Their unique “client-owned” ownership structure meant that it didn’t need to satisfy external investors seeking high returns. The index fund strategy required minimal operational overhead from the beginning—no teams of analysts, no expensive trading operations. Vanguard’s growth was organic and didn’t require substantial external financing rounds.

IKEA was almost entirely self-funded through operational cash flow. Ingvar Kamprad started with a small loan from his father to launch a mail-order business in 1943. The first furniture showroom opened in 1953, funded entirely from the profits of the mail-order business. IKEA’s rapid expansion globally was financed primarily through reinvested profits.

Remember, these are physical companies with materials, supply chains, inventory, and buildings. Software companies should be able to do the same with no more investment than this.

The common themes which allowed these companies to beat competitors for many decades in heavily-contested, commoditized markets, with increasing profits, with little financing, all with the lowest prices:

- Their strategy including trade-offs that many customers find distasteful or a “deal-breaker.” By targeting a subset of the market, accepting that for many customers the trade-offs were wrong, they dominated that subset.

- The weaknesses in their strategy were critical to preventing copycats, whether from existing competitors or new entrants. Others want to copy strengths, but won’t copy weaknesses. Because the weaknesses were mandatory to produce their strengths, they were never replicated.

- Their business models were profitable after just one store or with few products, not only once at scale.

(In SaaS, we would say: Profitable unit economics, with GPM above 70%, with a CAC payback period of less than a year.) - They reinvested profits into expansion, not extracted as dividends.

(This is an area where bootstrapped companies often diverge from funded ones, or founders with ambition to create a larger enterprise.) - They innovated in operations—not just in customer-facing products and features—to achieve their unique advantages and cost-effectiveness that enabled profit despite having lower prices.

- They started with narrower offerings in narrow geographic footprints and expanded gradually.

- They had a long-term vision and held inviolable values, never taking short-term short-cuts or compromises.

This should give hope to bootstrappers everywhere, or to folks wanting to raise sustainably-small rounds from strategic investors and advisors.

When the only differentiation a product can boast is that “it’s cheaper,” that’s not a strategy at all. The result is commoditization and a race to the bottom—if it gets off the ground at all. That’s why you mustn’t compete only on price.

That’s being cheap, not affordable. That’s a lack of vision, not a comprehensive strategy.

When lower prices are a result of strategy—business structure, cost structure, product trade-offs (that ICPs love but others hate), and other decisions that competitors can’t or won’t make, then low prices are a powerful, winning strategy.

https://longform.asmartbear.com/never-compete-on-price/

© 2007-2026 Jason Cohen

@asmartbear

@asmartbear ePub (Kindle)

ePub (Kindle)

Printable PDF

Printable PDF