How annual pre-pay creates an infinite marketing budget

Multiple founders have told me the ideas in this article were responsible for the financial success of their startup.

They might be exaggerating out of kindness, but if it’s even 10% as useful for you, it will have been worth your time.

We’ll explore how growth affects cash-flow, and conclude with several techniques that can transform the cash-flow of your business.

The cost of a dollar of MRR

What does it cost a SaaS company to add $1 of new monthly recurring revenue?

Using the typical acronyms:

CAC (Cost to Acquire a Customer) is the total cost to get one new paying customer—Marketing and Sales costs, including fully-loaded salaries.1 The simplest way to compute it is “total spend in a month” divided by “total new customers added during that month.”

ARPC (Average Revenue per Customer) is the average monthly-recurring revenue you get from a customer. The simplest way to compute it in aggregate is “total recurring-revenue in a month (MRR)” divided by “total number of paying customers during that month (N)”.

1 In smaller companies, typically the founder and others are spending time on marketing and sales activities as well; include the fraction of their time, or the salary that you would have to pay someone else to do those same tasks. Also include commissions.

Since it costs CAC dollars to get ARPC new dollars of recurring-revenue:

The cost to create one more dollar of MRR = CAC / ARPC

If you haven’t done it before, computing this metric will be eye-opening.

Let’s posit a hypothetical company with a $10/mo consumer-targeted SaaS product, where they pay $1.60/click for Google Ads; that traffic converts at 5% to a free trial, and those trials convert at 40% to a paid customer. Their CAC is $80,2 and their ARPC is $10, therefore we would say “it costs them $8 to create $1 of MRR.”

2

$1.60 / 0.05 / 0.4 = $80

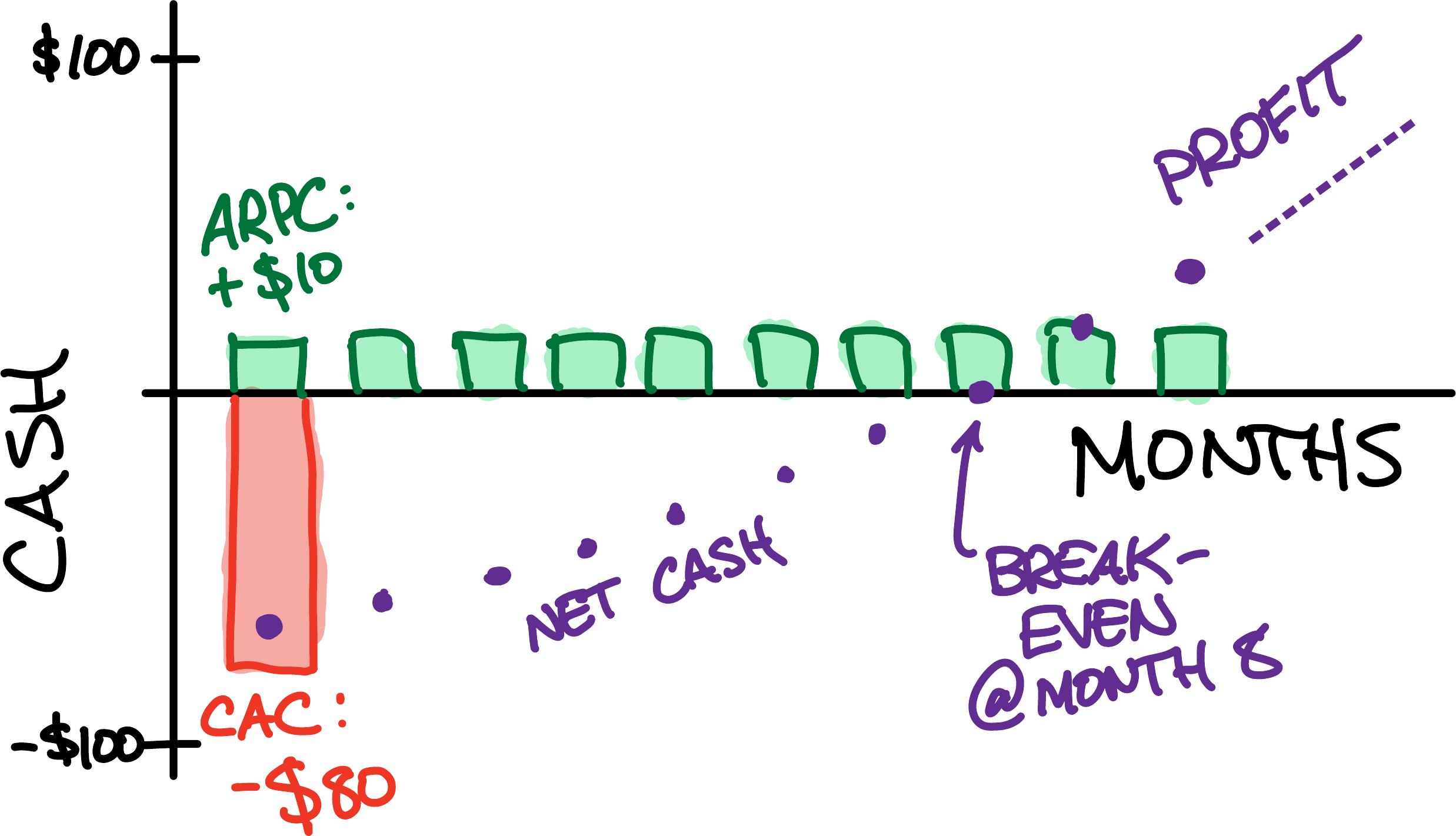

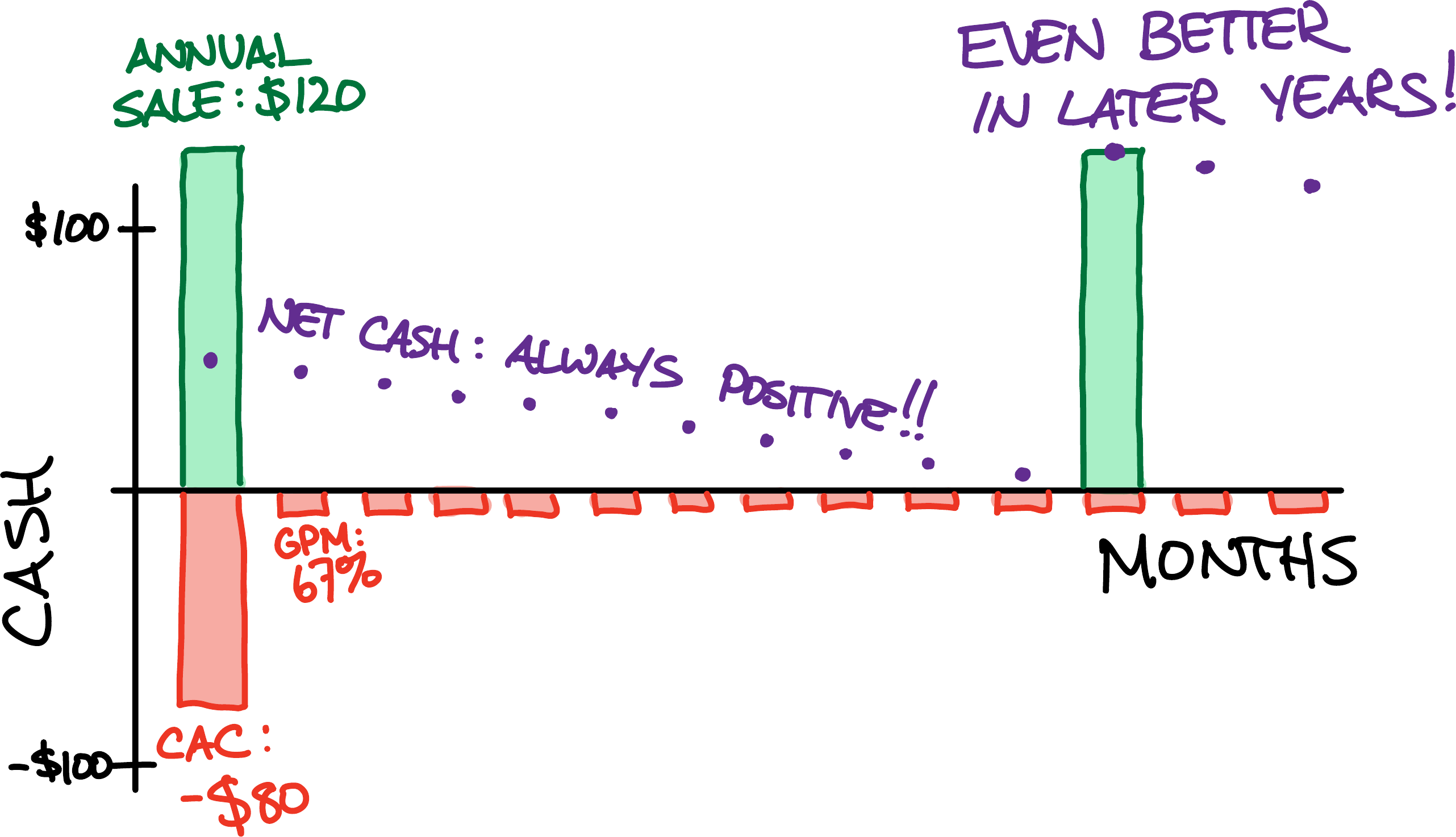

It’s tempting to conclude that “It takes 8 months of customer revenue to ‘pay us back’ for the marketing and sales costs of getting that customer. That customer is unprofitable before then, and becomes more and more profitable after.” (Figure 1)

Figure 1

But, unfortunately, it’s worse than that.

Revenue we can spend

All companies have mandatory expenses associated with delivering the entire product to the customer. Not just the product itself, but everything else the customer expects, like being able to pay with a credit card or call tech support:

- credit card processing fees

- tech support3

- infrastructure (if SaaS)

- professional services (if consulting)

- bill of materials (if physical goods)

- Anything else which, if missing, the customer would say “You’re not delivering the product I paid for.”

3 Even if you’re a solopreneur, doing support yourself, wanting to claim that therefore “support costs me nothing,” the opposite is true: Your time is valuable; you could have used that time for anything else, such as marketing or building a new feature. How should you account for this? Use whatever it would have cost to hire someone else to do the service for you, and remember that low-wage people who aren’t fluent in your language, can’t provide the level of service you’re currently providing!

In finance we measure these costs relative to revenue:

GPM (Gross Profit Margin) is the percentage of revenue remaining, after subtracting these “expenses required to deliver the whole product and experience.”

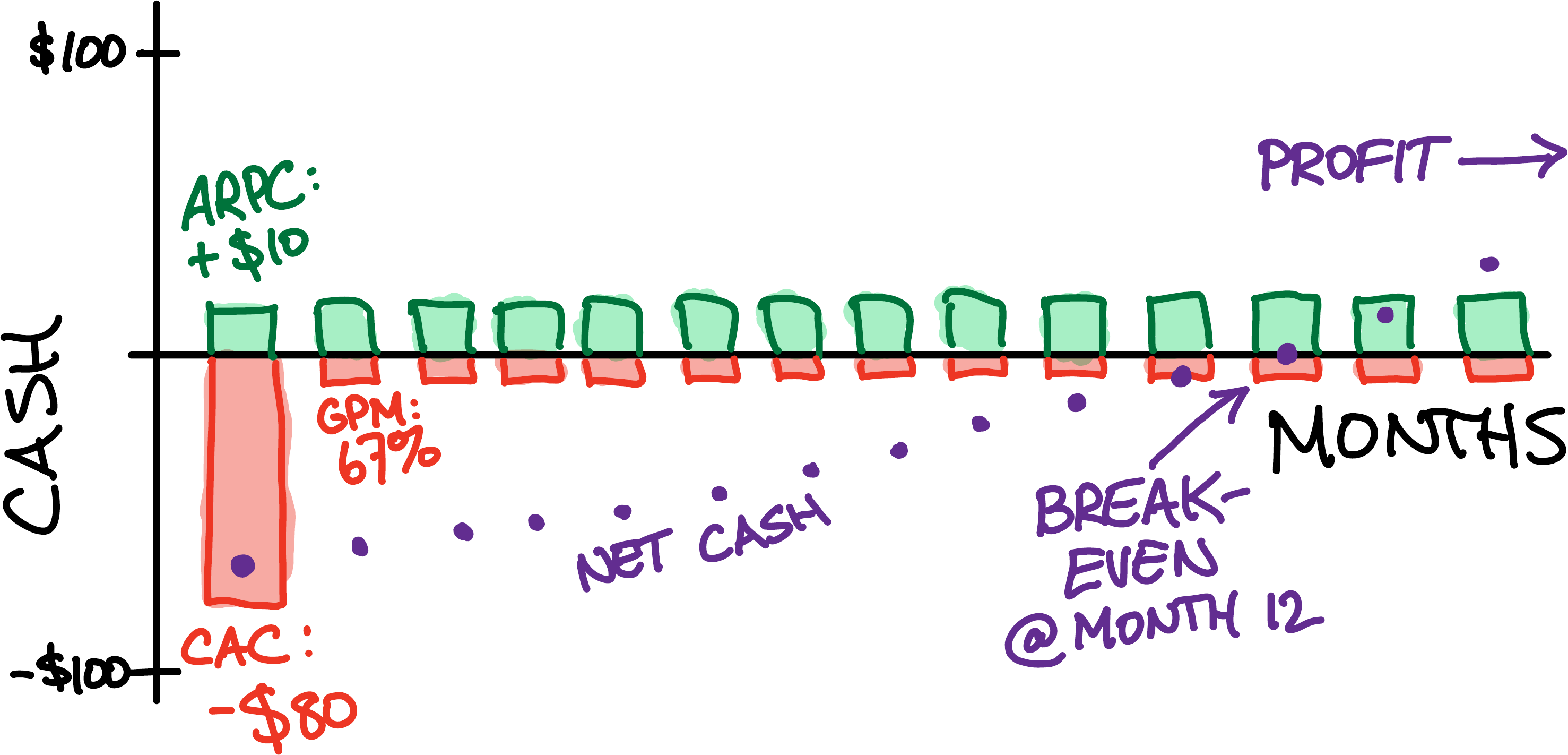

Continuing our example, suppose credit card fees are 3% of revenue, infrastructure costs are 5%, and tech support is 25%. Then GPM = 67%, i.e. after fulfilling our promises to our customers, we’re left with 67% of the money they gave us.

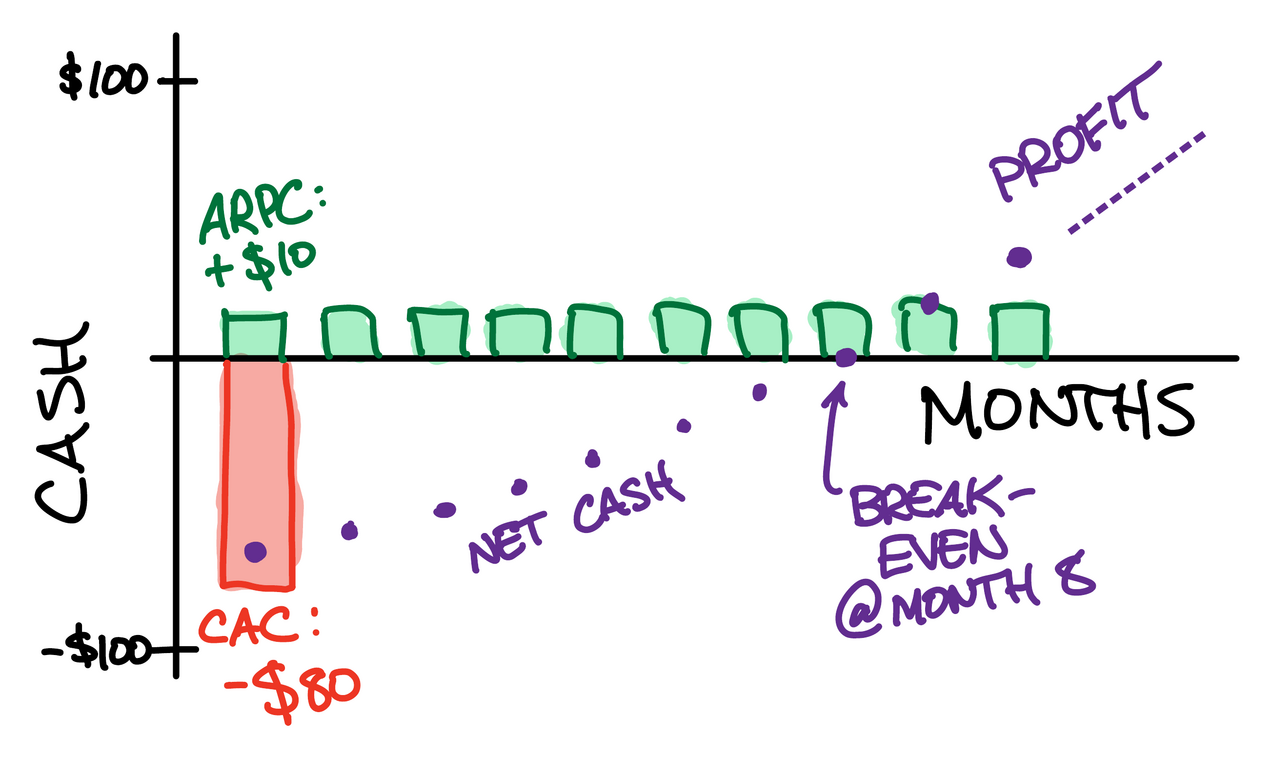

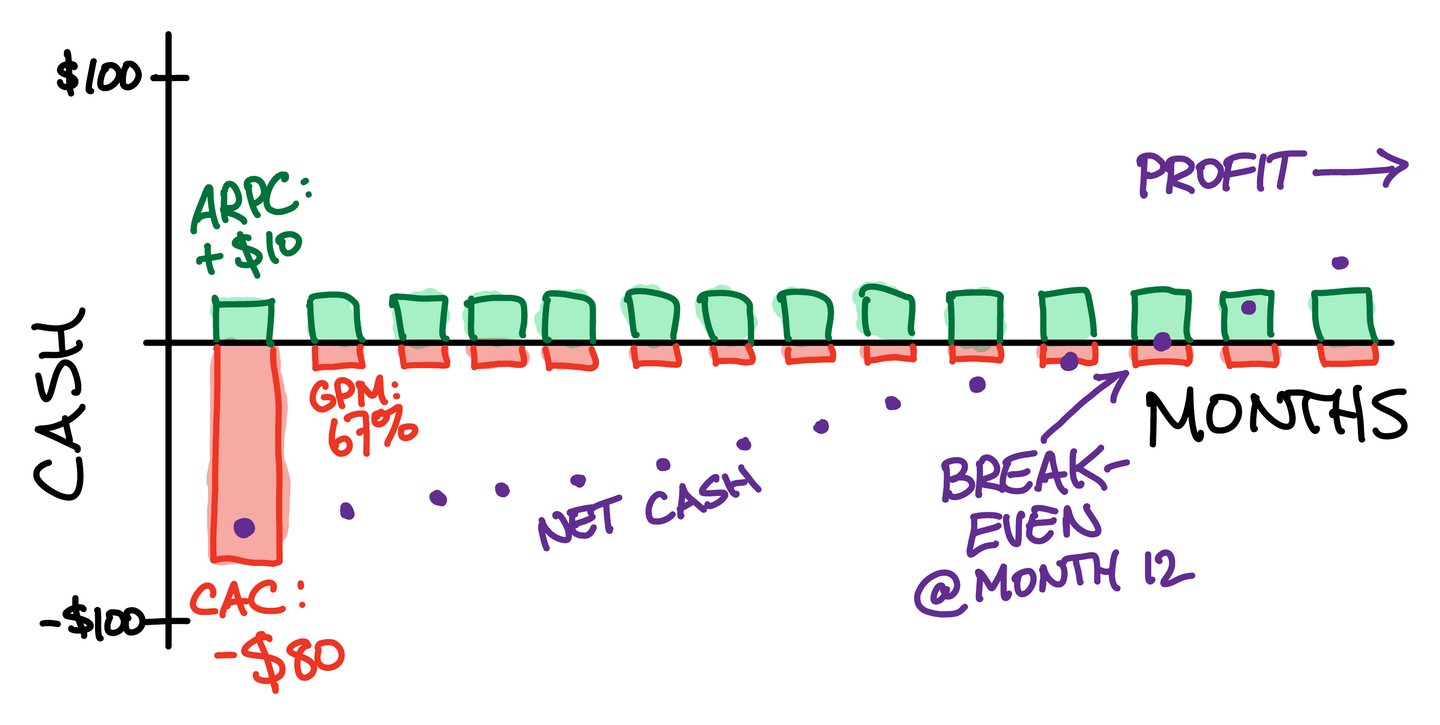

Payback period (p)

Now we’re prepared to compute the actual pay-back period: The amount of time needed to recover CAC expenses, which is the number of months of revenue we can spend:

p = “payback period” = CAC / (MRR ✕ GPM)

In our example, p = 80 / (10 ✕ 0.67) = 12 months. (Figure 2)

Figure 2

The cash-flow implications are harsh. Consider:

You’re bootstrapped. You scrape together $1000 from life savings or credit card debt. You spend it on ads. Happily, it works! With the numbers in our example, you now have $125 in MRR, but expenses are $42/mo, so it’s going to be a whole year before you get that $1000 back. Meanwhile, you’re just out that cash.

So… how do you get more customers? Another $1000… but how many times can you do that before you run out of savings? Now you can see why people raise money…

And the faster you grow the more cash it takes, because no matter how much you spend, it still takes a year to get it back. Now you see why people raise money for companies that are designed to grow quickly, and why it always takes more money than you think.

A few optimizations

Your mind immediately jumps to the question: How can I improve the metrics in this equation, so that my pay-back period is reduced, so I can grow more quickly with less cash?

Reduce CAC

Of course you’ll optimize advertising. However, everyone does this, and most advertising is an auction model, which means it’s difficult to find spaces that simultaneously (1) get enough traffic to matter and (2) are low-cost. It’s still worthwhile to optimize, or to try to find less-expensive channels, but this is incremental; it won’t transform your business. In fact, CAC increases as a company scales (because low-hanging fruit is already plucked) and increases as a market matures (because of auctions from more and more competitors, who have more and more budget), as I’ve documented.

Some people scream “Social media is free! SEO is free! Content marketing is free!” It’s not free—you have to write, manage, jockey for attention, follow Google’s whims, Twitter’s whims, YouTube’s whims, Instagram’s whims, TikTok’s whims, even though they don’t tell you what the whims are, and the whims change, optimize site layout as well as content, post often “for the algorithm,” and so on. These might indeed be great channels for you, but let’s not pretend that they are “free,” any more than you are “profitable on day one.”

Increase MRR

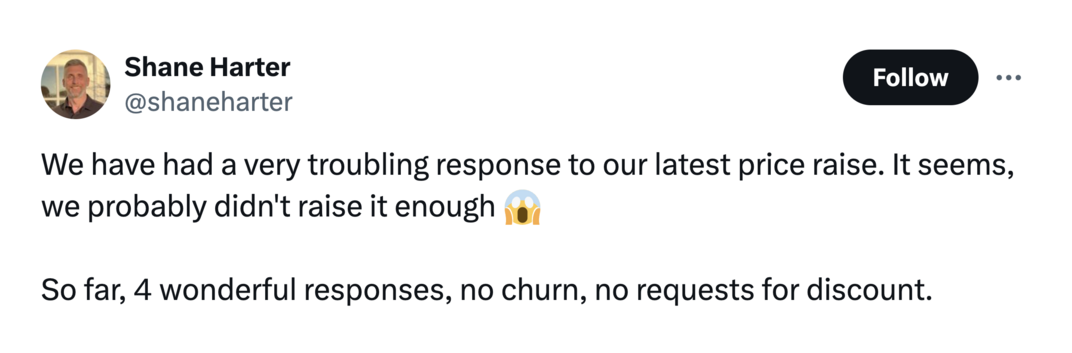

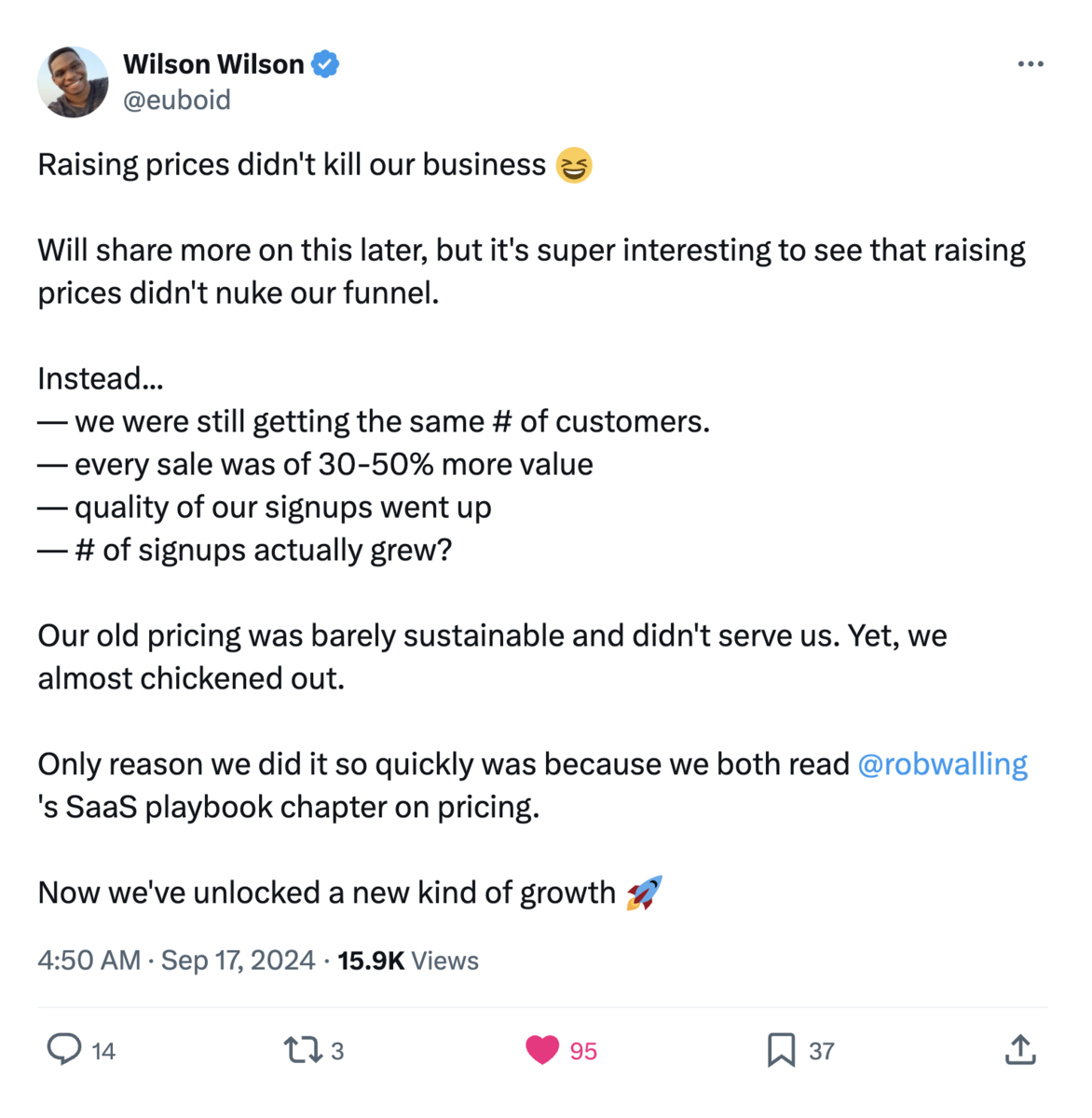

This is one of the main reasons why so many startup pundits (including myself) are always telling you to “raise your price.” The difference between $39/mo and $19/mo might not matter to your customers,4 but can cut your payback period to 1/3 of what it currently is.5

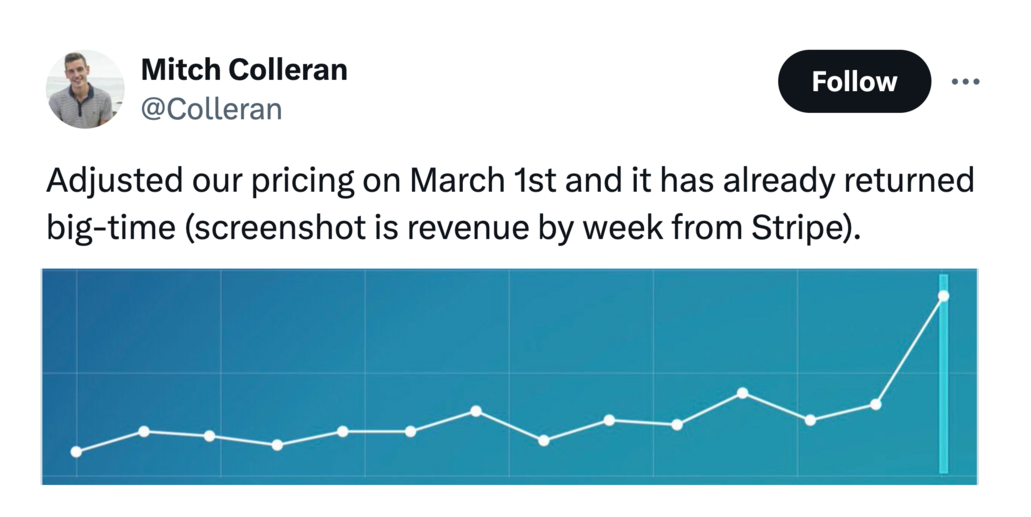

4 I know it sounds like doubling your price would dramatically reduce how many people sign up. However: (a) If sign-ups halve, you still have the same-sized business, except far more profit, and higher-quality customers, and (b) my experience and many others’ is that signups don’t halve; they might even go up. Examples below.

5 Cut into a third, not a half, becauseMRRdoubles but the costs behindGPMdo not, which meansGPMalso increases, so you get double-benefit.

You’re also probably not positioning the product properly. Here’s how you can 8x the price through better positioning, or how you can increase willingness-to-pay, which then allows you to increase price and growth and get word-of-mouth (which means lower CAC!).

You probably need more encouragement to summon the courage to try higher prices, so here’s a bunch.

It doesn’t always work, but typically, startups are under-charging.

Increase GPM (by cutting costs)

This is tempting, because it’s easier to cut costs than to raise prices, and easier to automate some tech support tickets or infrastructure rather than finding a new advertising channel. Especially for Engineers, who constantly fall into the trap of doing engineering stuff rather than what the business actually needs done.

Of course this is valuable work, and if it’s easy to cut support-time in half with a few days of keyboard macros or better documentation or an AI first-line-of-defense, then do it. Just be warned that your natural tendency will be to file the rough edges off of costs—which isn’t impactful—rather than work on pricing and marketing—which have the power to transform the trajectory of the company.

Remember, you can only cut costs so much, but the potential upside of better marketing or pricing is uncapped. This is one of several reasons why better marketing and pricing is strategic, while cutting costs isn’t.

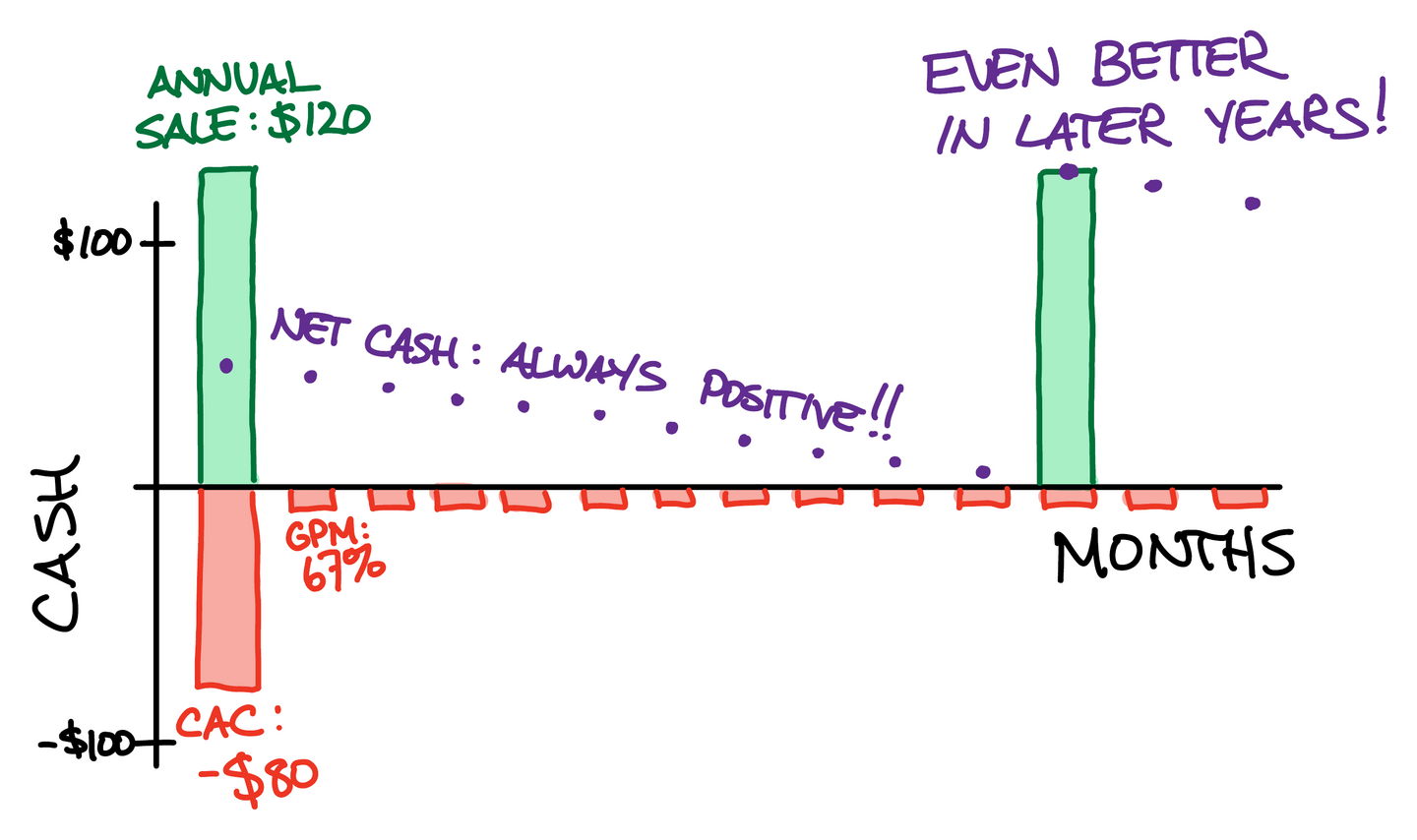

The transformation: Annual billing

There’s another thing we can try: Billing plans where the customer pays annually instead of monthly.

How much should they pay? Typically you reward the customer for their up-front payment with a discount. In our example, the product is $10/mo; you might offer a plan at $100/year, exclaiming “get two months free!” on the pricing page.

This is a great excuse to raise prices slightly: Offer the annual plan at 12 times the current monthly price, then increase the month-to-month price by something like 20% (i.e. the “2 months free” amount). Existing customers can be grandfathered in, or ask them to switch to annual to preserve their monthly rate.

What does this do to our payback period?

In terms of cash:

- Before: We paid $80 to get $10 of MRR, which is $120/year.

- Now: We paid $80 and also got $120/year, but we got the $120 today.

This gives us an infinite marketing budget. To see why:

- We spend $80 on ads. But not in cash; it’s on our credit card.

- We get $120 in our bank account, in cash. We mentally set aside the

GPMcosts that we will incur, that this income will need to cover. Those costs are $40, which leaves us with $80 that we’re free to spend. - Later, our credit card bill comes due, and finally the $80 ad cost leaves our bank account.

- Which means we never actually lost the $80, in terms of cash!

We received the $80 from the customer before we sent away the $80 for the ad, even after setting asideGPMcosts.

This completely transforms the growth potential of the business, without raising money.

In real life, not all customers select annual plans. However, this is still transformative because:

- Even if only a third of customers select an annual plan, it’s still a huge impact to cash-flow.

- You could raise prices on the monthly plans even further, which both (a) increases selection of the annual plan and (b) decreases the pay-back period of the monthly plan.

- You could offer an annual plan only. (However an “even more expensive monthly plan” is typically a better way of saying yes instead of no, as it retains optionality for the customer and is very profitable for you.)

Commonly-asked questions

After espousing this policy for more than a decade, here are the common questions and conversations:

- I hear that annual-plan customers cancel less often. So, will encouraging annual plans also decrease my cancellation rate?

- No, but it is useful in cancellation analysis.

The reason people on annual plans have a higher retention rate, is that they self-select into those plans. What type of person does that? A person who is already intending to stay. So, offering annual doesn’t change your overall cancellation rate, but it does segregate customers in a useful way: Those more likely to cancel are now identifying themselves.

Which means, you can contact them and learn more about why they feel that way, and possibly then do something to improve cancellations, which is likely one of the most valuable things you can do. You can also compare their behavior and responses with those on annual plans, to tease out what’s actually different between the cohorts.

- When someone on an annual plan cancels after, say, seven months, should I refund them the remainder of the term?

- You can pick anything along this scale of generosity:

Refund pro-rata.

If they cancel after seven months, then refundof their original payment. This has the benefit of simplicity and promoting your reputation as being generous.

Refund as if monthly.

In retrospect, the customer is acting like they are on a monthly plan, so compute what they would have paid in that case, and refund them the difference. For example, if the annual plan is $100/year, and the monthly plan is $10/mo, and they cancelled after 7 months, then they would have paid, therefore you refund them

, which is less than if you refunded 5 months of their annual price, i.e.

. This also means if they cancel very late in the year you don’t refund them at all, as a monthly plan would have been even more expensive.

Credits.

Rather than refunding cash, provide credit on the customer’s account. Perhaps they’ll buy something else in future, or they want to switch to a less expensive plan, or switch to monthly billing.

No refunds.

We have all experienced this with contracted services like our phone bill or corporate services. This is of course the least-generous approach, so you have to decide whether this policy adheres to your cultural values, your sense of business ethics, and whether you want to employ this tool as a type of coercive relationship. - What if the customer cancels before the payback period elapses?

- Astute readers will notice that the “payback period” model didn’t include cancellations.

Clearly, not all customers who sign up on day 1 will still be here on day 30, much less day 300 or day 3000. In particular, if they cancel before the payback period, that’s a net-loss for the business. Don’t we need to account for that somehow?

Yes! Cancellations were omitted here for simplicity, but in practice you cannot ignore them. A simple way to account for them, is to first calculate your retention rate across the nominal payback period. For example, if payback is 12 months, what is your 12-month retention (r)? Excellent for Enterprise software isr = 95%; for SMB is75%; Shopify is just50%.

Then, we declare that the customers who stay, must make up the costs for the customers who leave. Therefore if the nominal payback period isp(as defined earlier), we actually need to waitp / rto get paid back.

This formula is not exactly right either, but it’s a simple method that gets you to the right vicinity. - What about all the other expenses at the company? CAC isn’t the only cost.

- That’s right, saying “infinite budget” is artistic license to make the point, which is that it’s transformative for cash flow.

I hope you can use annual plans to dramatically change your cash-flow!

Many thanks to Fabio Caravita for the idea of providing credits instead of cash refunds.

https://longform.asmartbear.com/annual-prepay/

© 2007-2026 Jason Cohen

@asmartbear

@asmartbear ePub (Kindle)

ePub (Kindle)

Printable PDF

Printable PDF