Too small to fail: How startups can grow in recessions

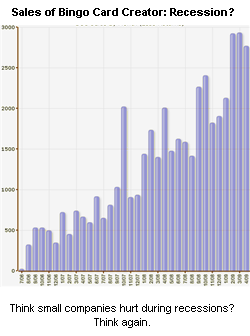

A little product called Bingo Card Creator just had its biggest month ever. Patrick McKenzie runs this one-man software company.

In fact, February, March and April were its three biggest months since its inception in 2006. What recession?

Yes, you read that right. The Bingo-card-generation-software industry is growing while every sector of the economy is simultaneously in the toilet.

Patrick McKensie is too small to fail.

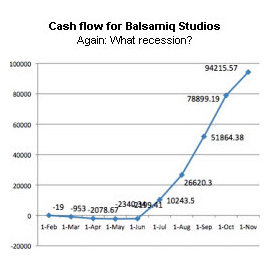

Think Patrick is alone? Balsamiq Studios is growing even faster. After their user interface mock-up design product netted $162k in their first year of business, today they’re making so much money they’re embarrassed about it. They pulled in $35k during the first week of April alone.

Balsamiq Studios is too small to fail.

How?

If your niche is small enough, the customer need strong enough, your marketing targeted enough, your product good enough, your customers happy enough, they are going to buy, recession or not.

That sounds like a lot of “if"s, but let me show you that it can work.

If your goal is to have a huge company and sell $100,000,000 of software per year, you’re going to have a tough time. You’ll almost certainly fail, it will take years, it will take cooperation among many people you haven’t yet met or hired, it will take a massive market, it will take beatable competitors, and it will probably take debt and/or investors. And yeah, a down economy could be your undoing.

But if your goal is to run a smaller successful business and be independently wealthy, it’s different. If you’d be happy making $1,000,000/year or even $200,000/year, many potential problems fall away. A small, focused market changes the rules.

In a small, focused market, you don’t need a big marketing budget to get noticed. You know where your customers hang out—the forums, blogs, community sites, influencers, local groups. You even know the keywords for AdWords and it’s easy to optimize, like Patrick did. It takes time—but not a lot of money—to participate and get noticed.

In a small, focused market, you can become the world expert of your niche. You can build the most popular blog, the most frequented forum, the best collection of how-tos, the most comprehensive eBook, the simplest, yet most complete software. Or, in my case, the most popular paperback book on a subject (50,000 copies and counting).

In a small, focused market, you can deal with competitors. The competition might be weak or there might be plenty of room for several winners. Competitors are easy to find and track and analyze. It’s possible that you’ll never see an 800-lb gorilla because the addressable market is too small for them to ever be profitable (Microsoft isn’t going to make a Bingo-card creator). Any other competitor starting now will be way behind; if you keep moving they won’t catch up.

In a small, focussed market, you can delight customers one by one. You can develop fans and cheerleaders who will buy anything and everything you make and spread the word to everyone else in the community. You can quickly amass testimonials for your website that sell your services and products better than any brochure possibly could. It’s easier than you think; just be yourself.

In a small, focused market, recessions don’t hit as hard. Your potential customers have a strong need, not a passing interest. Your existing customers have a personal relationship with you and will go out of their way to help you succeed, even in tough times. Because of your small size, 99.99% of your customers are still in your future, so there’s always new customers to discover.

Small means all sorts of options open up to you, that incumbents can’t compete with even if they try!

Prevailing wisdom is that “small is risky.” It’s just the opposite. When you just need to be Ramen-profitable, you can do so even in a recession.

Care to wager? In one year, who’s more likely to survive: Balsamiq Studios, or a company with $30m paid-in capital that wasn’t profitable even before the recession but has “amazing growth potential in a hot market?” Whose founders are more likely to put $1m cash in their pocket over the next few years?

Remind me again—what’s wrong with small?

https://longform.asmartbear.com/startups-in-recessions/

© 2007-2026 Jason Cohen

@asmartbear

@asmartbear