Darwin doesn’t automatically select the best companies

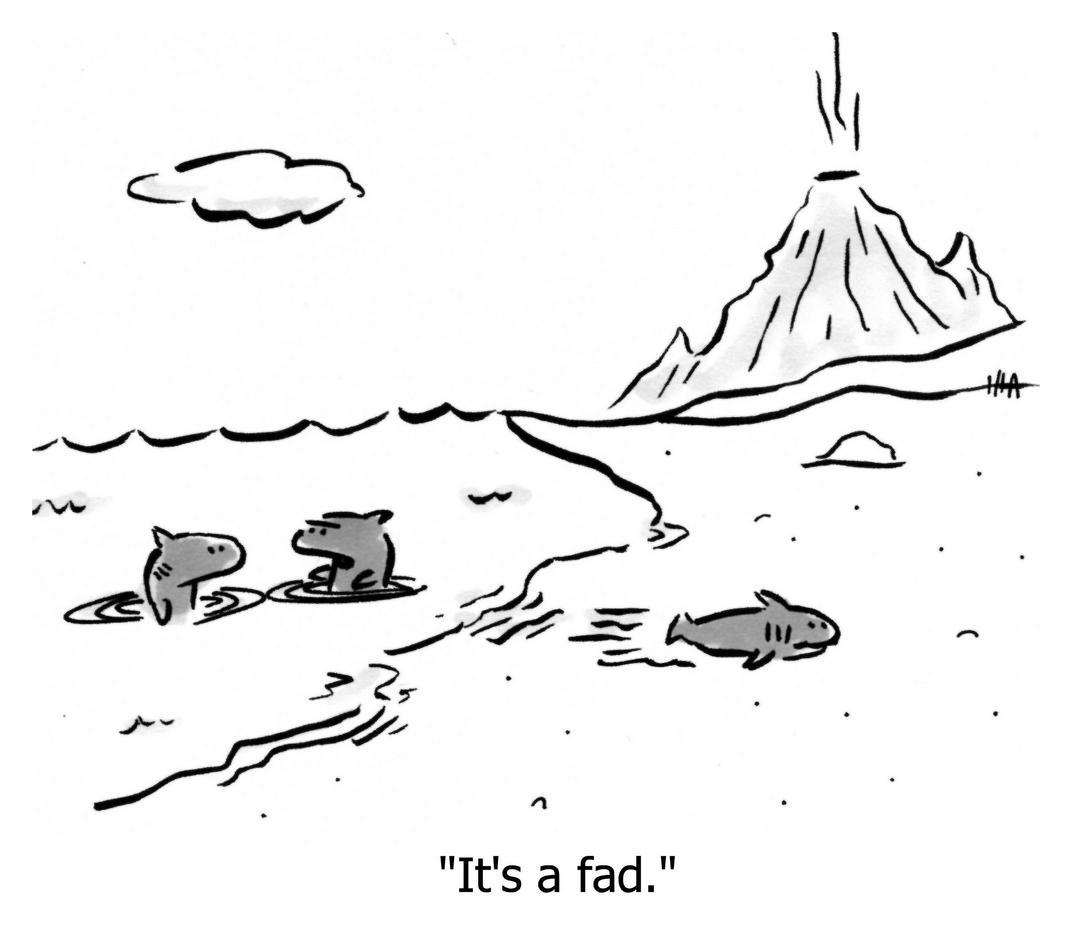

“Survival of the fittest” is not the same thing as “survival of the best,” though this is not obvious at first glance.

“Fittest” means “most prolific at becoming grandparents.” Sound weird? You might think “fittest” means “most prolific at creating offspring,” but that’s not true if the offspring themselves are unable to reproduce. A horse mated with a donkey creates a mule that is sterile; the line ends.

The “grandparent” requirement is the only requirement. There’s no other notion of “good” or “bad,” like humans have with ethics or how we want our companies to work. Which means “bad” things can be just as “fit” as “good” things. Viruses are amazingly fit—becoming grandparents at prodigious rates, quick to spread and difficult to stop once noticeably numerous.

That last bit should sound familiar if you follow Theories of Startup Laws & Metrics. Investors and founders alike have been obsessed about “growth at all costs,” just as a virus colony grows without care to its effect on its host cells or whether the colony’s growth ends up destroying the host body completely, taking the colony down with it in a viral version of Lord of the Flies. Similarly, we hold up “viral growth” as the best sort of growth, because exponential curves overwhelm all others, thus once the mechanism is stable and the company gets large enough to be noticed, it’s neigh-impossible for competitors to catch up.

There’s nothing inherently wrong with obsessing over growth. In winner-take-all markets, growth is objectively the correct goal.

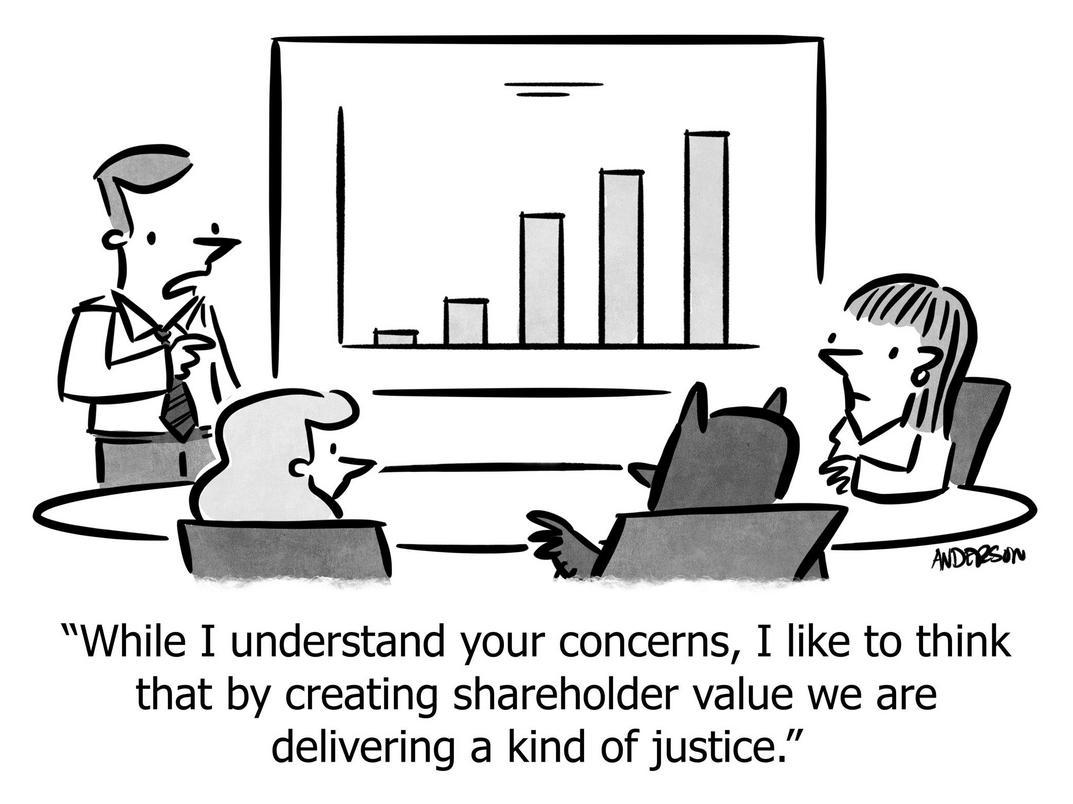

The problem is “growth at all costs.” When “growth rate” becomes the only important metric for company “fitness,” other metrics are left unsolved.

“Profitability” is perhaps the most-talked-about example of a metric left unsolved. Many companies who won the growth battle never figure out how to convert themselves from a virus to a business. Some already passed into the zone of “can never be profitable unless something drastically changes,” (e.g. GroupOn, Zynga, SoundCloud), whereas many are able to continue due to massive investment, and the jury remains out on whether they can ever produce profits (e.g. SnapChat, Pinterest, WeWork, InstaCart, Square, FourSquare, and even Twitter, who has impressive revenue but has still never been profitable). Presumably, some will and some won’t ever figure out a business model, but the point is that their position as “winners of the market” is due to being an excellent virus in a Darwinian sense, not due to possessing an excellent business model.

“Betterment of humanity” is an even less-talked-about example of a metric left unsolved. Libertarians might not care whether a company earns a profit by making the world a little bit better or extracts a toll by making it a little bit worse. But it seems to me that it’s our duty as entrepreneurs to create companies which leave the world better than we found it, or at least not make it worse, and our duty as employees to invest the majority of our waking hours and the most productive years of our lives in companies that make the world better, not just “hit a number.”

Many of the market-winners do make the world better. Despite famous setbacks, advances in biotech over the past few decades have resulted in longer and better quality of life. The success of WordPress world-wide (25% of all domains) makes it orders of magnitude cheaper to completely own your website, without which you are invisible and voiceless. Amazon’s cloud computing services enable the creation of technical products and services which would be impossible to create a decade ago, both for new startups and 100-year-old companies still reinventing themselves into relevancy.

But many of the winners are a mixed bag. Uber makes so-called “entrepreneurs” out of under-paid employees who were indentured servants to the taxi medallion system, but they are still indentured and still under-paid. Twitter connects people and ideas but kills attention spans and stokes hate more than debate. Google puts the world’s information at our fingertips but destroys personal privacy in ways more insidious than most people want to know. Self-driving cars will solve traffic, dramatically improve the environment, provide transportation for people who can’t or shouldn’t drive a car, and could even transform the landscape as parking lots and garages become obsolete; they will also destroy millions of jobs in the transportation industry, many of them high salaried relative to the job-holders’ level of institutional education.

Darwinian growth wins by definition; there’s no arguing that, no use crying about it, and government regulation will only delay the inevitable while shifting the location of the winners to other countries.

It’s up to we entrepreneurs and employees both, to ask whether growth is sufficient. Whether we stop at growth metrics or whether we accept additional objectives. Whether our companies will uphold other values as also being inalienable and unassailable, allowing those additional values to drive our most important decisions, and asking growth to be compatible with those values.

The real question is not how to retard growth in submission to other values, but rather how to use our insistence values to drive growth.

Fortunately, there are many examples to inspire us:

- Small

- Buffer is a 5-year old company with profits and growth, in the overcrowded space of “Social Media Tools,” with a product that’s not particularly special or unique (sorry guys, love you but it’s true!), where talent nevertheless beats their door down to work there even in cases where they know ahead of time they’ll take a pay-cut (because salaries are set by a formula). This is not because Buffer’s product is “changing the world” but because of the company’s devotion to complete transparency and positivity, being honest about struggles and successes, and of employees’ health and well-being. This is growth driven by values.

- Mid-Sized

- TOMS shoes is a massive success, not because of a superior product, but because of a viral story that people want to support and retell, exactly because its mission is so commendable and pure. This is growth driven by values.

- Large

- USAA—with the incredibly boring home page title of “insurance, banking and retirement solutions”—is the 49th most valuable company on Earth with $24 billion in annual revenue and $3 billion in profits. Their customer service consistently earns NPS between 75 and 80—some of the highest scores in the world—so their financial health is matched by customers who truly want the product. USAA is well-known for being one of the best places to work, even in traditionally low-paying, low-formal-education positions such as customer service, and for their overwhelming and unwavering commitment to families of the US Armed Forces. This is growth and profit driven by values.

In short, you can grow and be profitable exactly because of goodness and love (That article details many ways to do it.)

Building a virulent company is wonderful, but only if the virus carries beneficial effects—creating customers who love the service, creating employees who enjoy spending most of their waking hours at work, and creating effects to our economies, communities, and societies that are net-positive.

When you build your unstoppable company, make it an unstoppable force for good.

https://longform.asmartbear.com/darwinian-company-growth/

© 2007-2026 Jason Cohen

@asmartbear

@asmartbear ePub (Kindle)

ePub (Kindle)

Printable PDF

Printable PDF