Your target market isn’t demographic

I don’t like the traditional target market definition that focuses on demographics and firmographics:

- We sell to small businesses in the UK.

- Our fast-casual restaurant appeals to college students and young professionals.

- We target outdoor enthusiasts in the Pacific Northwest

- Our TV show is targeted at females, 19-29 years old.

Sometimes this sort of description warranted. If you sell back-office software specifically for dentist offices under Norwegian law, then a demographic description is accurate. But my experience is that, for most companies, these dimensions incorrectly describe the market.

Take the TV show above. Despite the stated demographic, most females 19-29 don’t watch that show. Why not—what differentiates those who watch from those who don’t? Conversely, many people who are not females 19-29 do watch it. Why? Your actual “target market” is described by whatever characteristics are shared by the watchers, and are distinct from the non-watchers. Even if you’re roughly correct that the named demographic accurately describes many viewers, you’re missing the deeper value and desirability of your own show, and therefore targeting too many people (the females 19-29 who aren’t actually your target) and also targeting too few (everyone else who is). You’ve avoided naming the actual “target.”

What will the advertisement for that show say? “Hey, if you’re a female 19-29, watch this!” No, it will appeal to something else—people who like that genre, people who like those actors, people who enjoy that aesthetic, people who like that writing style, people who want to be seen as the type of person who would watch a show like this. Whatever that is, is the target market, and should inform the advertisement.

The same lesson applies to business products. Consider an email client. It might be used personally or at work. It might be used at a small company or a large company. It’s not language-dependent. So, traditional market dimensions are irrelevant: “B2B or B2C”, company-size, or geography. Rather, the target market depends on the use-cases and characteristics of the users. It may be optimized for people who get hundreds or thousands of emails every day and therefore need special processing workflows. Or for people who have assistants that process mail on their behalf. Or for people who get only a few emails per day. Or for people who worry about security. Or for people who do systematic outbound campaigns. Or for a shared support desk. These attributes have to do with the use-cases of the customer, not demographics nor firmographics.

Let’s make this concrete with an apparently-inexplicable scenario that most B2B software companies will relate to.

Why Google also buys “SMB” software

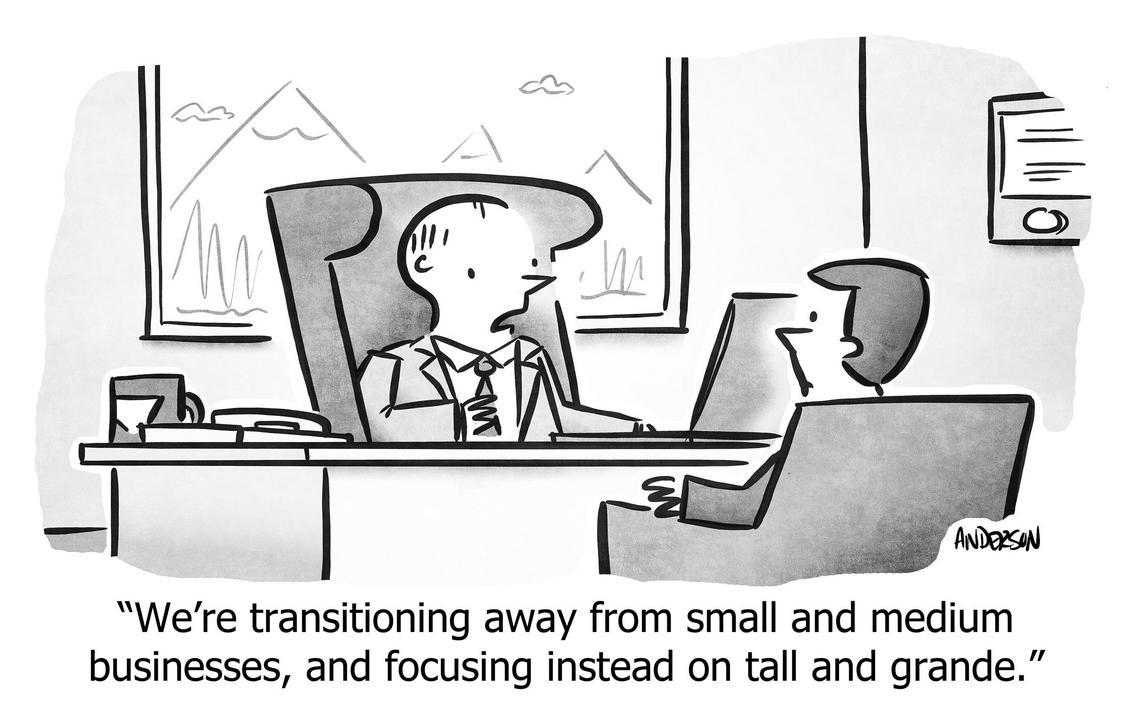

In the early days of my company WP Engine, our website design (Figure 1) belied the fact that we were a small company selling to SMBs (Small and Mid-sized Businesses) who had a successful WordPress1 site. We were not positioned to be impressive to even mid-sized companies, to say nothing of large enterprises.

1 WordPress is by far the most popular site-building software, used by nearly half of all websites globally.

Figure 1: WP Engine’s early website design screaming “We’re a small business selling to small businesses.”

And yet, mid-sized and large companies bought too. Less in the first two years, but substantially in the next two years. We wouldn’t land “Enterprise-sized” multi-million-dollar contracts, but rather they bought the same product that the small customers bought. What did it mean? Maybe it’s a sign that we should start selling directly to the Enterprise!

Many startups experience this pattern. Twitter is full of founders with good, simple software, shocked to find that Google, Facebook, Salesforce, and Oracle have become customers, asking the melee-that-is-social-media whether this is evidence that they should “go up-market” with a sales team.

The short answer is: No.

The full answer is: You are quite understandably under the delusion that “company size” is a good way to characterize your target market. Occasionally that is a good way, but in fact software designed for small businesses is almost guaranteed to be purchased by big businesses also.

The reason is that individual teams at large companies also buy things. Not everything at Google is purchased top-down and forced upon the roughly 27,000 engineers that work there. (If your software is purchased top-down and forced, then you are indeed selling to the enterprise, and that should be included in the definition of your target market.)

Those teams are buying for the same reason the one (and only) team at a small business is buying, and that reason defines your target market. In turn, it also defines your advertising, positioning, pricing, and features.

In my case at WP Engine, lots of people have WordPress sites, for lots of reasons. For a small business it might be their main website; at a large enterprise, it might be part of a marketing campaign, or a community project, or a “labs” team, or all sorts of reasons:

- One of the largest banks in the world used us to allow bank branches to publish their own content.

- One of the largest software companies in the world used us for their developer-relations portal.

- One of the largest software development tools companies used us for their public technical documentation.

- One of the largest fast-food chains in the world used us to publish social content in small countries, where local agencies could get all the details right (culture, language, color, etc).

This happened because our target market wasn’t “small businesses and individuals with WordPress.” It was people who used WordPress who value:

- Enterprise-grade quality (e.g. speed, scale, security, 24/7 high-quality tech support).

- A flexible, open-source, inexpensive-to-build platform where it was easy to hire employees or agencies anywhere in the world.

- Pricing that was 10x or 100x larger than “cheap hosting” but

or

as much as “enterprise CMS solutions”.

These are characteristics needed by a mid-sized company’s home page, or one of the use-cases for an Enterprise. These are the common threads; these are pieces of the definition of the “target market.”

You can find more pieces of that definition by continuing to ask “why do they value those things?”

They value “Enterprise-grade” because they valued the website (as opposed to throw-away websites, or websites just for fun where price really is an issue). They value flexibility because they wanted to be able to change it themselves, or because they wanted to outsource anywhere in the world. Some wanted WordPress specifically because individual marketers were often already familiar with WordPress because of personal projects, and therefore could build and manage WordPress-based websites at work.

The result of this chain-of-whys is internal clarity, and the path to effective marketing. For example, if your segment were “mid-sized companies,” what would we say on the home page? “WordPress for mid-sized companies?” Great… soulless, boring, and what exactly the definition of “mid-sized” anyway? But now consider something as simple as “Enterprise-Grade WordPress.” Or perhaps “Affordable Enterprise-Grade WordPress.” You could make it even more authentic and interesting and better, but at least it’s being specific about its strengths (i.e. affordable, reliable, high-quality). It’s already an improvement.

How to identify your actual target market

Techniques and frameworks

This is part of what you’re doing when you find and then interview customers. You’re trying to get at their view of the problem you solve, how they describe it, what constraints they have, what would compel them to buy.

You use this information to identify your ideal customer profile and target everything for only them. Don’t add company size, or industry, or geography, unless that is inextricably tied to the nature of the product, where it truly cannot be sold or used outside of that boundary.

You use the Needs Stack framework to define where you fit in into customers’ “Maslow Hierarchy of Needs.” You select the dimensions of Love and Utility at the intersection of your personal motivation and what will delight customers. These intersections are your target market.

In short, this isn’t fundamentally different from existing techniques for understanding customers and markets. You’re just seeing that there are more important characteristics than demographics and firmographics.

The testimonial test

The way you can check whether a certain customer profile [B] matches the target market of your existing customer profile [A] is by asking this question:

Would customer [B] be swayed by a genuine, effusive testimonial given by [A]?

That is, would they say: Oh wow, yeah that person’s situation is just like mine, so alright, I’m interested, I’ll give it a try.

Sometimes proactively thinking about this question helps you to define the target market in the first place. It can even be used to directly test it—by seeing whether testimonials in sales calls light up people’s eyes, or whether inserting them on landing pages increases conversions.

In particular: Gather a list of your best customers, where “best” is defined by high retention, propensity to upgrade, reports “10” NPS, proactively leaves positive reviews and advocates for you on social media, engages with beta-testing or ideation for new features. Their shared characteristics help you define your target market, as would asking “what types of organizations and people would care about their testimonials?”

George Moore said it best in Crossing the Chasm back in 1991, when he defined “a market” as:

• a set of actual or potential customers

• for a given set of products or services

• who have a common set of needs or wants, and

• who reference each other when making a buying decisionPeople intuitively understand every part of this definition except the last. Unfortunately, getting the last part—… the tendency of [a market] to reference each other when marking buying decisions—is absolutely key to successful high-tech marketing.

Notice that he, too, did not mention demographics2 or firmographics, but rather a “common set of needs or wants” and that they see each other as references.

2 Contrary to my formulation, he goes on to say that if two people buy the same product, even for the same reason, but don’t actually communicate with each other, they are not in the same market. He gives the example of an oscilloscope for monitoring heart beats, saying that a doctor in Boston and one in Zaire have “no reasonable basis for communicating with each other,” and therefore they are different markets. I believe this is less true in today’s connected world (see the next section), and especially in software, I like the slightly less restrictive version that I gave above.

Market segmentation dimensions for the modern age

Historically, some market dimensions were forced upon us due to technical and societal constraints that no longer exist. It used to be that the only thing TV shows could know about an audience are things like gender and age, mediated by only a few firms like Nielsen, but that’s no longer the case. It used to be extremely difficult to accept credit card payments or transact in many countries and many currencies, complying with local taxes and trade laws, but companies like Stripe, PayPal, Paddle, and FastSpring have made that accessible to everyone, breaking down the traditional constraints of geography and currency. AI tech support and translations might soon break down language barriers.

We’ve already seen some examples of what dimensions we might use instead. Here’s a list of ideas; most will not be applicable, but they’ll get the thoughts flowing:

| Dimension | Notes |

|---|---|

| Individual vs team |

Sometimes can be “both,” e.g. if a free single-player-mode gets people hooked, but teams is where the money is, e.g. project management like Asana or Notion. |

| Integrations | Nowadays, most software interacts with other software, whether part of a workflow, or because of the addition of AI, to-do system, project management, or chat. |

| Other software used daily | What else do they use every day, whether that suggests integration or just helps to characterize what customers expect and experience |

| Processes | What other processes and workflows do they use, or aspire to use, particularly as those intersect your product? |

| JTBD success | What objective numbers are they held to? Which are vital vs operational? Which are satisfied vs maximized? What number, changing how, would get them promoted? Fired? |

| Personal success | What fulfills them? What makes them happy? What is so compelling, they will put up with other things they don’t like, or advocate for you within the company? (Their Needs Stack.) |

| Professional success | How are they evaluated? How do they get promoted? How are they seen as a success in their field? Early-career professionals have different priorities than mid-career or late-career individuals, regardless of company size. |

| Corporate goals | Is the primary goal of their company revenue growth rate? Revenue size? Profit dollars? Profit percentage? Market-share? Rule-of-40? Cost-savings? Increased GPM? |

| Role inside company | Are they customer-facing or inward-facing? Do they interact with other departments or keep to themselves? What do others expect of them? |

| Title | What titles does this person with this role have? Probably a variety, especially if the product should span companies in different industries, or of different sizes. |

| Problem ownership | Who “owns” the problem you’re solving? Is it centralized in one role or distributed across a team or organization? Is the problem-owner and solution-owner the same person? |

| Cultural attributes |

Does their organization prioritize productivity or work-life balance? Do they teeter over ethical lines or stay firmly in or out of bounds? Are they focused on external innovation or internal efficiency? |

| “

Crossing the Chasm” lifecycle phase |

What best describes the customer: • innovators—tinkerers; not used in production. • early adopters—leading-edge; takes risks on new technology only if it creates a competitive advantage. • early majority—wary; only well-known vendors; requires not just product but customer service, integrations, implementers, or other support. • late majority—scared; dragged kicking and screaming into this decade by investors or market pressures. |

| Work style | Do they work from home, only in office, or hybrid? Are they separated from co-workers by time zones? How many hours do they work per day? Do they work synchronously or asynchronously? |

| Technical acumen |

Where are they on the spectrum from “engineers who will argue with you about algorithms” to “technophobes reluctantly using devices they hate”? |

| Risk tolerance | Organizations analyze risk and accept risk differently. For example, creating new markets requires customers who accept risk. Risk-attitude is uncorrelated with company size. |

| Tech stack philosophy | Do they prefer open-source, proprietary, cloud-native, or on-premise solutions? Often stems from values, not just technical needs. |

| Update cadence | Do they prefer frequent incremental improvements or infrequent but substantial updates? Shapes product development rhythm. |

| Communication culture | Are they email-heavy, Slack-dependent, or meeting-oriented? Affects how they’ll use and integrate your product. |

| Organization size | SMB is often bought by larger, but not vice-versa. Best when selling top-down, or when the organization itself is relevant, e.g. HR software. |

| Organization growth trajectory | Is the customer in hyper-growth, steady state, or declining? Each stage creates different priorities and constraints. |

| Regulatory environment | How heavily regulated is their industry or function? What regulations? Affects feature needs, compliance requirements, and risk tolerance. |

| Budget type | Does the buyer have a fixed/annual budget, flexible budget, or “find money when needed” approach? Is there a clear budget threshold where the sale is significantly different? |

| Sales process | Is this a top-down sale or bottom-up freemium / PLG? If the former, that might also be correlated with company size; the latter often isn’t. |

| Decision cycle | Some make decisions in hours, others in weeks, others in quarters. |

| Emergency vs deliberate | Is the decision made because of an urgent condition (e.g. security breach) or is it made deliberately, with research, comparisons, or trials? Do they run pilots and A/B tests or make all-or-nothing commitments? |

| Maker vs administrator | Is the primary user a person who is creating, making, delivering, or someone who is managing, monitoring, analyzing, reporting? |

| Business model | Subscription, one-time, transaction-based, usage-based, freemium, ad-supported, etc? Can dictate what metrics they care about most, how they can pay, and how they see the product fitting into their value-chain or cost structure. |

| Learning style | Do they prefer video tutorials, documentation, 1:1 training, or figuring things out themselves? Shapes marketing, onboarding, and support. |

Most of your answers will be “don’t know” or “don’t care,” and you should invent new dimensions, but hopefully this gets you moving on the path to a better target market definition.

When in doubt, go back to your current, best customers. Your target market is the set of potential customers that your best customers self-identify with, in the sense that they would view each other’s testimonials as compelling.

They themselves might not know exactly why; it’s your job to figure out what characteristics define that set. But your best customers hold those answers. Through analyzing the problems they face, the way they wish to solve them, and the rest of their context, through observation and interrogation, you can develop a crisper list of characteristics that you can then target in marketing, identify in sales, and optimize for in product.

Discovering what you were always meant to be, and now becoming that, on purpose.

https://longform.asmartbear.com/target-market/

© 2007-2026 Jason Cohen

@asmartbear

@asmartbear ePub (Kindle)

ePub (Kindle)

Printable PDF

Printable PDF